We have very little data to drive markets this week, especially around the main macro theme of when the Fed and the BoE are going to start moving interest rates. The sterling was almost stagnant against the dollar until US sessions, as projections for forthcoming rate hikes in the US and the UK provided equal prominence to both currencies.

While USD has once again latched onto recent upbeat comments from Fed Chair Yellen far more than the US rates markets have and so we remain a little wary of how far the USD can push on its own.

Technical Glimpse:

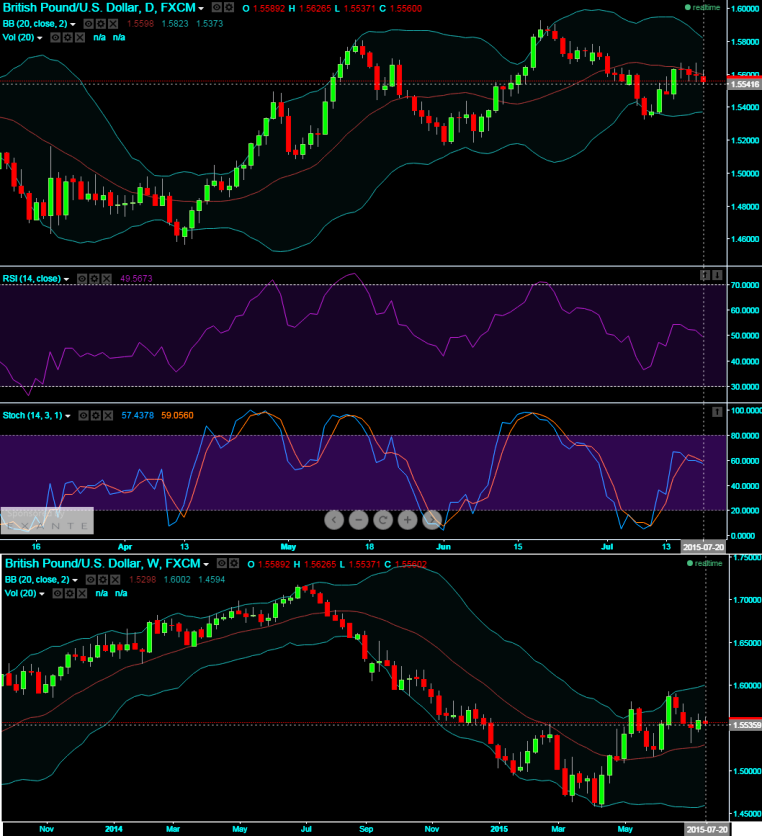

Cable failed to find support at 1.5554 (previous day's low) and resistance at 1.5671, (previous day's high), the pair is now likely to head towards a strong support at 1.5452 (last week low) and resistance at 1.5673 last week's high.

On EOD charts, flurry of dark candles formed after a streak of bearish swings experienced last month. It is now traced 2 Doji's occurred back again one at 1.5631 and another one at 1.5596 levels to confirm the previous bearish trend.

RSI (14) converges these bearish movements as the prices slump accordingly. (RSI currently trending at 49.3667), while %D line crossover again on stochastic which can't be deemed over bough circumstance but it signifies the buying interest has been missed out. But, nothing much happening on weekly trend but little weaker here as well.

£/$ remains stiff but little bearish owing to optimism of Fed’s rate hike

Monday, July 20, 2015 12:28 PM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate