3M Company, an American multinational company operating in the fields of industry, consumer goods, worker safety, and U.S. health care, announced its plans to set up long-term value by spinning off its health care business.

As per Reuters, 3M Company revealed its spin-off plans on Tuesday, July 26. With this move, the industrial firm just joined the other major companies that are also aiming to simplify their business and increase their stock price.

It was noted that many other companies have also taken the same step last year. They have broken up their firms to form new units, and this trend was actually on the rise last year. This happened after Wall Street agreed that firms do better when their focus is streamlined.

In fact, last year, Toshiba, Johnson & Johnson, and General Electric Co. have all taken the spin-off route and either split up or divested their businesses. Now 3M's healthcare business is planning the same thing and will be forming a unit that will focus on healthcare technology, wound care, and oral care. The company’s healthcare line was said to have contributed about one-fourth of 3M’s total revenue last year.

"Today's actions advance our ability to create value for customers and shareholders. Disciplined portfolio management is a hallmark of our growth strategy,” Mike Roman, 3M’s chairman and chief executive officer, said in a press release.

The company chief went on to say, “Our management team and board continually evaluate the strategic options that will best drive long-term sustainable growth and value. The decision to spin off our Health Care business will result in two well-capitalized, world-class companies, well positioned to pursue their respective priorities."

The new 3M will continue to bring profitable growth and stir up strong cash flow. It is also expecting to return capital to its shareholders while keeping a strong balance sheet.

The company will carry on prioritizing strategic opportunities and investing for its growth, sustainability, and productivity. Finally, 3M said it does not expect any changes to its capital allocation priorities even after the separation of its healthcare unit is completed.

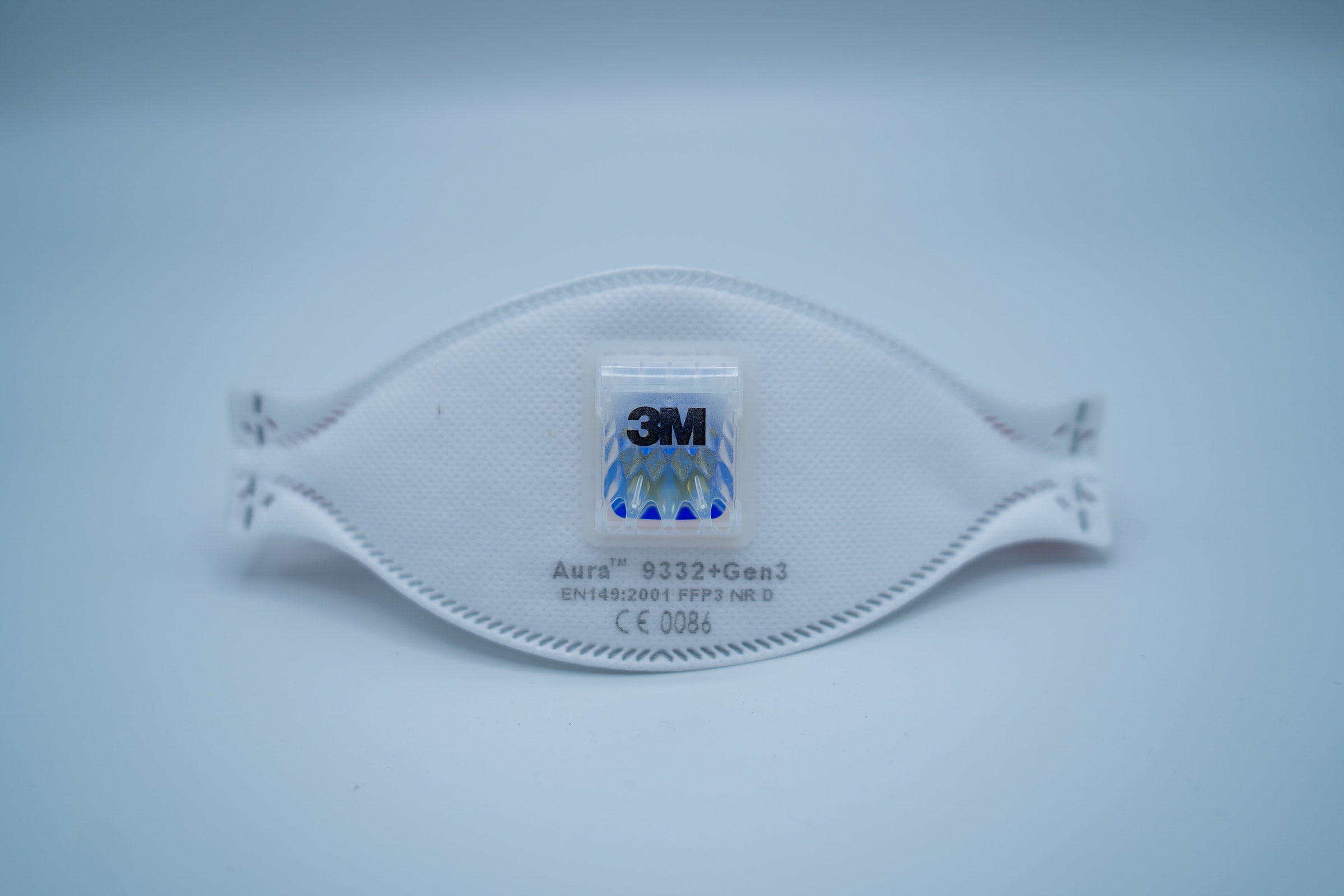

Dimitri Karastelev/Unsplash

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026