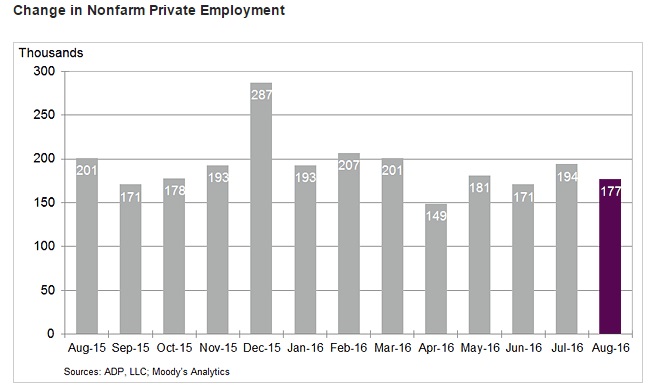

Today ADP employment numbers were released from the US for the month of August.

ADP number shows US economy and its labor markets are resilient and the recent momentum loss is stabilizing.

There are two things to note even in the headline that,

- U.S. labor market has stabilized and the weakness seen in April and May looks to be temporary.

- July payroll got a robust revision. It has now revised to 194,000 (up from 179,000). June was revised lower to 171,000 (-5,000).

Key highlights

- Non-farm private sector employment grew at 177,000 in August, median expectation was for 175,000.

- Small business sector hiring at 63,000, compared to 61,000 last month.

- Employment in franchise increased to 19,200 compared to last month’s 21,200.

- Mid-sized companies added 44,000 jobs compared to last month’s 68,000 jobs.

- Large sector added just 70,000 compared to last month’s 50,000 jobs.

- Manufacturing sector payroll registered no job gains or losses compared to 4,000 jobs gains last month.

- 6,000 jobs were lost in goods-producing sector, compared to last month’s 6,000 jobs losses.

- Construction sector saw 2,000 job losses, compared to last month’s 6,000 job losses.

- Services sector employment remains robust as payroll added 183,000 people in July. July gains were 185,000.

The dollar index is currently trading at 96.13, up by 0.13% for the day so far.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January