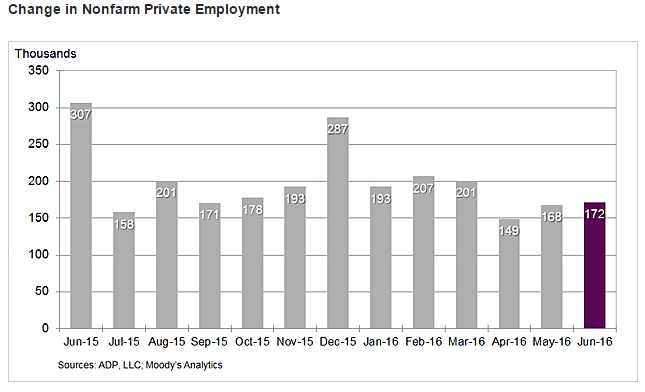

Today ADP employment numbers were released from US for the month of June.

ADP number shows US economy and its labour markets is resilient in second quarter but lost some steam.

There are two things to note even in the headline that,

- Job growth is much weaker in April and May but the decline seems to be stabilizing.

- May payroll marginally revised to 168,000 (down from 173,000). April was revised lower to 149,000.

Key highlights –

- Non-farm private sector employment grew at 172,000 in June, median expectation was for 159,000.

- Small business sector hiring at 95,000, compared to 76,000 last month.

- Employment in franchise increased to 40,700 compared to last month’s 19,400.

- Mid-sized companies added 52,000 jobs compared to last month’s 63,000 jobs.

- Large sector added just 25,000 compared to last month’s 34,000 jobs.

- Manufacturing sector payroll declined by 21,000 jobs compared to 3,000 jobs losses last month.

- 36,000 jobs were lost in goods producing sector, compared to last month’s 1,000 jobs losses.

- Construction sector saw 5000 job losses, compared to last month’s 13,000 gains.

- Services sector employment remains robust as payroll added 208,000 people in June. May gains were 175,000.

Dollar index is currently trading at 95.99, down -0.15% for the day so far.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength