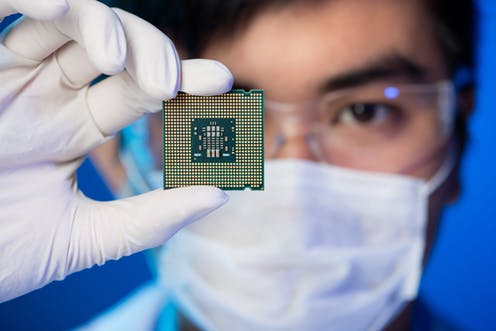

The global semiconductor market is set to grow 9.5% in 2025, driven by soaring demand for AI and data center chips, according to ING analysts. While this growth lags the 11.2% forecast by the World Semiconductor Trade Statistics (WSTS), it surpasses long-term industry projections by ASML.

AI-driven semiconductors are fueling market expansion, but traditional segments like PCs, smartphones, and automotive chips are under pressure due to weak consumer demand and pricing challenges. Despite NVIDIA (NASDAQ:NVDA) dominating the AI chip market, its latest earnings disappointed investors, while Samsung Electronics (KS:005930) lowered its AI semiconductor outlook. Meanwhile, Advanced Micro Devices (NASDAQ:AMD) reported $5 billion in AI chip revenue for 2024 and anticipates strong double-digit growth in 2025.

Taiwan Semiconductor Manufacturing Co. (TW:2330) predicts AI accelerator chips will grow at a compound annual rate of over 40% in the next five years, significantly outpacing its overall revenue expansion. Additionally, the industry is seeing a shift toward custom chips (ASICs) for data centers, benefiting companies like Broadcom (NASDAQ:AVGO) and Marvell Technology (NASDAQ:MRVL), but intensifying competition for Intel (NASDAQ:INTC) and AMD.

Although near-term memory chip pricing remains uncertain, strong demand for high-bandwidth memory and cutting-edge logic chips is positioning the semiconductor industry for sustained long-term growth.

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026