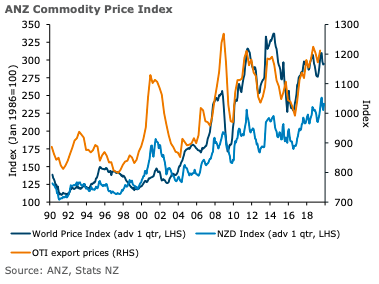

The ANZ’s World Commodity Price Index lifted 0.3 percent m/m in August following two months of weaker prices. Dairy and forestry sectors lifted in August but this was largely offset by weaker prices for meat and aluminium.

The index has gained 0.9 percent in the past year. In local currency terms the index lifted 3.9 percent m/m, bolstered by the 2.1 percent fall I the New Zealand dollar Trade Weighted Index during August.

Shipping costs were firmer in August despite concerns of slowing global trade as the trade war between China and the United States escalates. The Baltic Dry Index lifted 27 percent during August to reach its highest level in almost nine years.

The supply of ships is reducing as owners dock ships to make alterations to meet the tighter environmental regulations that will be imposed next year. Dairy prices gained 1.3 percent in August, reversing the weakness seen the previous month.

Milk powder prices firmed but butter prices softened. Dairy prices are currently bumping along but are yet to show the upward trend that slowing global growth in milk supply suggests is due. However, aluminium prices fell 3.1 percent in August after gaining 2.4 percent in July. The price of this metal has been bouncing along for some time.

Recent tightening of production in China pushed up the aluminium price within that market but prices elsewhere remain subdued as concerns grow about weakening global economic conditions.

"We are forecasting further downward currency movement in the coming months, supporting returns to New Zealand producers," ANZ Research further commented in the report.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure