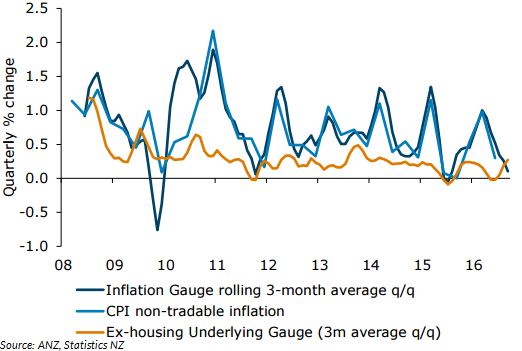

Inflationary pressures in New Zealand continue to be drowsy; however, certain action was detected. ANZ’s monthly inflation gauge for New Zealand rose 0.2 percent in September. Momentum was provided by reasonable rises in accommodation services and insurance, underpinned by housing and health groups. Increase in price in construction and property maintenance costs continue to be seen; however, recent sharp increases have eased slightly. Costs of telecommunication and transport dropped modestly in September, noted ANZ.

The Underlying ex-housing gauge was up 0.3 percent three month-on-three month. This was the largest rise in two years. The figure is still weak, said ANZ. Prices of accommodation increased throughout the board, owing to a strong tourism sector. Increases in vehicle and health insurance counteract a decline in life insurance costs.

Rents registered a small rise after easing in the previous three months. This measure is expected to show more action as high house prices usually push more people into the rental market. Out of the 36 main series, 22 remained the same, whereas 10 rose and four dropped.

Annual inflation from the gauge is weak and lost ground in September. It rose just 2.1 percent. Historically, this is low for the measure and reflects the current environment where inflation expectations are low and there are signs that relationship between inflation and growth has broken down, stated ANZ.

Even though there are pockets of prices rising, on a whole, there is not much evidence that inflation is accelerating. However, the underlying gauge is indication signs of beginning to move, though off a weak starting point. Subdued inflation keeps the bias for the OCR skewed lower, according to ANZ.

ANZ monthly inflation gauge for New Zealand rises in September

Monday, October 10, 2016 5:09 AM UTC

Editor's Picks

- Market Data

Most Popular

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January