WTI is continuing its downward slide, only hindered by profit booking to counter sellers at rallies. Export ban lift hasn't boosted price either amid supply glut.

Key factors at play in Crude market -

- US lawmakers passed bill to lift 40 year oil ban on US crude export.

- Brent has fallen to discount against WTI.

- Despite Saudi Arabia's signal for cooperation OPEC meeting broke without any accord. OPEC dropped reference to any ceiling.

- Tensions continue in Middle East but not sufficient to push crude higher.

- OIL futures indicating price below $60/barrel, till 2024.

- Due to new and improved technologies, crude oil production cost has declined for shale producers.

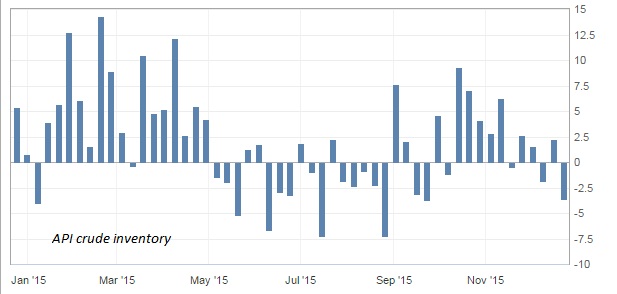

- American Petroleum Institute's (API) weekly report showed inventory dropped by -3.6 million barrels, highest since September.

- Oil price is down, however lack of investments in the sector make prices vulnerable to supply shocks in future.

Today's inventory report from US Energy Information Administration (EIA), to be released at 15:30 GMT.

Trade idea -

- We at FxWirePro remains committed to downside, price action suggests further drop in prices likely towards $33.5, $28.5 and $23. WTI is currently trading at $36.7/barrel.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX