Australia's Q1 GDP report released on Wednesday came in largely in line with market forecasts but weaker than the implied quarterly forecast published in the RBA’s May Statement on Monetary Policy. Australia's GDP rose by a modest 0.3 percent q/q in Q1, compared to 0.2 percent estimated in Reuters poll. The annual growth was down to 1.7 percent from 2.4 percent in Q4. This is the lowest rate of growth since 2009.

The slightly better than expected data came one day after the Reserve Bank of Australia (RBA) cautioned that growth "is expected to have slowed in the March quarter." The central bank held rates unchanged at 1.50 percent and said it remains upbeat on the global outlook, domestic business conditions, and non-mining investment outside the regions impacted by the mining downturn.

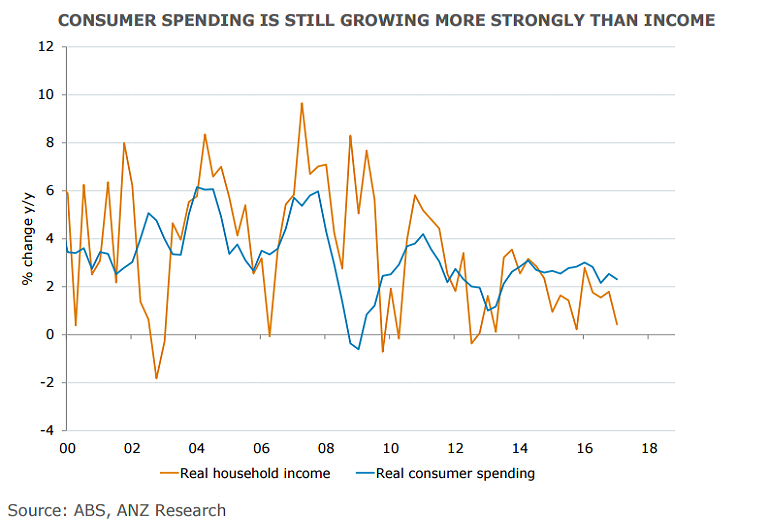

Australia's economy just managed to squeeze out enough growth to stay out of a recession for the 26th year running. That said, as households struggle with paltry wage rises and punishing debt, its sustenance is in doubt. Unit labour costs rose 0.6 percent q/q, but are only 0.1 percent higher than a year ago suggesting an absence of domestic inflationary pressures and confirming that the RBA is on hold for some time.

The inflation indicators extended weakness. The household consumption deflator rose just 0.3 percent q/q, while the core rate was up just 0.2 percent and is only 0.8 percent higher over the year. The weak GDP data for Q1 will not unsettle the Reserve Bank of Australia (RBA) as it had expected a weak result.

"There looks to have been a sustained step-down in the pace of consumer spending growth as households adjust to the new world order of very low wage growth. On that front, wages growth actually picked up in the quarter, but growth in unit labour costs remains negligible, which suggests that inflation is likely to stay low. On this whole, this confirms our view that the RBA is on hold for some time," said ANZ Markets in a research note.

Aussie buoyed after Australia Q1 GDP beats estimates. AUD/USD rose to 0.7566, the highest level since April 25, and is currently hovering at session highs. The pair has broken 200-DMA at 0.7531 and close above will see further upside.

FxWirePro's Hourly AUD Spot Index was at 96.6914 (Bullish), while Hourly USD Spot Index was at 33.229 (Neutral) at 1145 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks