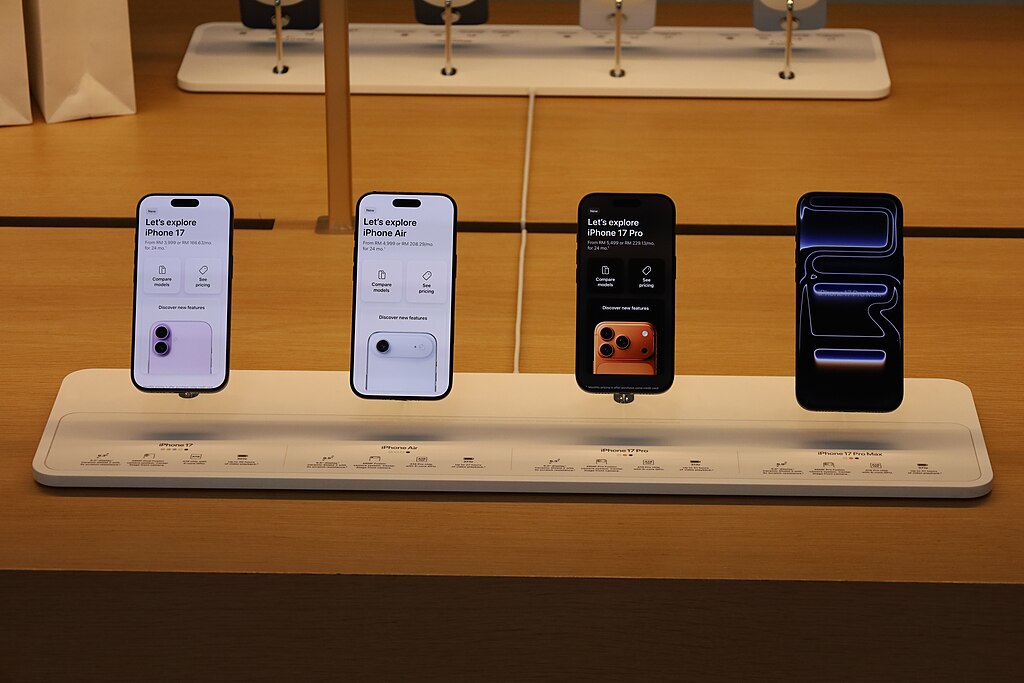

Shares of Apple Inc. (NASDAQ:AAPL) suppliers soared across Asia after strong early data showed the iPhone 17 series outperforming its predecessor in both China and the U.S. The iPhone 17 lineup sold about 14% more units than the iPhone 16 in its first 10 days, according to Counterpoint Research, signaling robust demand ahead of the holiday season.

Apple’s stock hit a record high overnight, bringing its valuation close to $4 trillion and boosting optimism across global markets. Taiwan Semiconductor Manufacturing Co. (TW:2330) and Hon Hai Precision Industry Co. (TW:2317) each rose over 1%, while LG Innotek Co. Ltd. (KS:011070), a key camera component supplier, jumped more than 5%. Samsung Electronics Co. Ltd. (KS:005930), a rival and major Apple supplier, also gained 1.5%, pushing South Korea’s KOSPI index to an all-time high.

Chinese Apple suppliers Luxshare Precision Industry Co. Ltd. (SZ:002475), Lens Technology Co. Ltd. (SZ:300433), and Goertek Inc. (SZ:002241) advanced between 3% and 5%, while Hong Kong-listed AAC Technologies Holdings Inc. (HK:2018) rose 3.4%. Japanese suppliers Murata Manufacturing Co. (TYO:6981) and NOK Corp. (TYO:7240) also posted slight gains.

The iPhone 17’s positive launch is expected to strengthen Apple’s December quarter results, supported by year-end holiday spending. The base iPhone 17 model has attracted particular consumer interest, with Apple maintaining previous pricing despite tariff concerns that had weighed on its shares earlier this year.

Apple’s recent $100 billion investment pledge in the U.S. further fueled investor confidence, signaling the company’s long-term commitment to domestic growth and innovation. With the iPhone 17 series off to a strong start, Apple and its global supply chain appear poised for a solid finish to the year.

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate