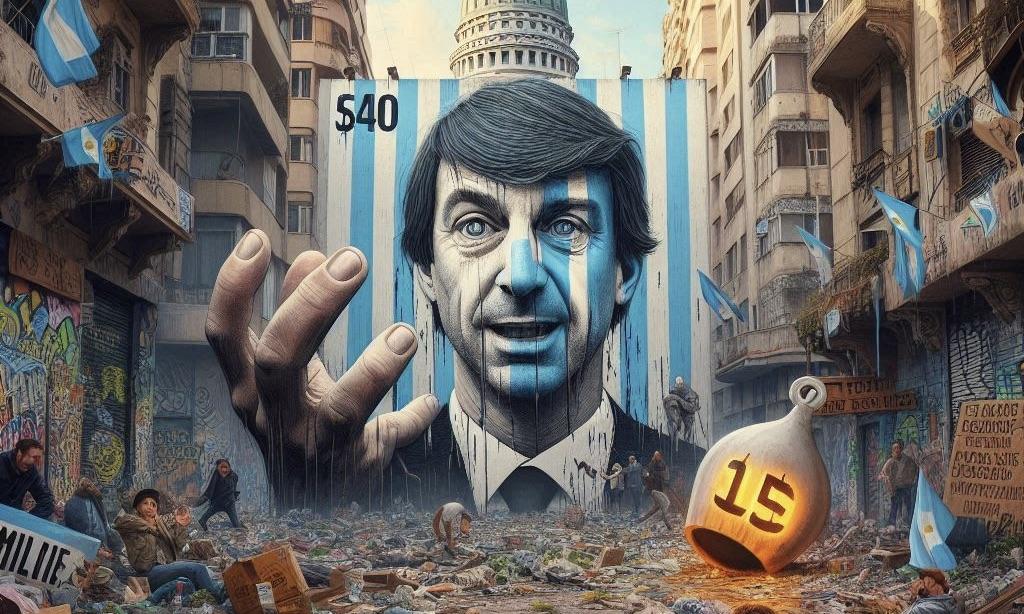

Argentina’s poverty rate has surged to 52.9%, its highest level since the 2001 crisis. President Javier Milei’s austerity measures aimed at reducing inflation have severely impacted households, with inflation still near 237% and many struggling to make ends meet. The economic recovery remains uncertain.

Argentina’s Poverty Rate Hits 52.9% Amid Milei’s Austerity Efforts and Soaring Inflation

In the first half of the year, Argentina's poverty reached its most significant level since the aftermath of the 2001 financial crisis. President Javier Milei implemented a shock therapy program to revive an already declining economy.

According to government data released on September 26, the number of Argentines living below the poverty line increased from 41.7% in the second half of 2023 to approximately 52.9% in the year's first half. This increase results from a robust cost-cutting initiative intended to reduce inflation, which the government cautions would have continued to escalate in the absence of the initiative.

“This is a number that, surely, will reflect the crude reality that Argentine society is going through as a consequence of the populism that has put Argentina through so many years of disgrace and devastation,” presidential spokesman Manuel Adorni said in a preview of the data at a press briefing earlier on September 26.

The increase in Argentina's poverty rate, determined by a basket of household products and average wages, was propelled by annual inflation that approached 237%. Since the latter half of 2017, the percentage of individuals unable to make ends meet has more than doubled.

Although yearly consumer price increases have decreased from a zenith of 289% in April, they remain significantly higher than the 18% that Milei is confident will be achieved by December 2025. Milei liberated price controls on everything from milk to phone bills severely devalued the currency and allowed price gains to outpace pensions and public wages in the first months of the year. As a result, monthly inflation has decreased to approximately 4%, down from nearly 26% in December.

Amid Early Signs of Recovery, Argentina Faces Protests and Strikes Over Milei’s Austerity Measures

Despite being plagued by its sixth recession in a decade, the second-largest economy in South America is exhibiting the first signs of recovery. According to Yahoo Finance, this is evidenced by wage growth, which has surpassed inflation for three consecutive months, and recent consumer spending and manufacturing increases. Agriculture and mining were the primary drivers of the 1.7% increase in economic activity in July compared to the previous month.

However, the consistent budget surpluses that have aided in containing inflation may be jeopardized by opposition to the government's austerity initiative. This month, Milei vetoed a measure that would substantially increase pension spending, which incited violent protests outside of Congress. Public universities are threatening additional public unrest and a 24-hour strike next Wednesday in response to the libertarian's promised veto of their expanded budget.

The evidence of increasing hardship is widespread. The capital of Buenos Aires has become a hub for individuals who ring doorbells, dig through the garbage, and beg outside grocery stores in search of used clothes. Adorni stated that the government has increased funding for the country's primary child support and food stamp programs.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady