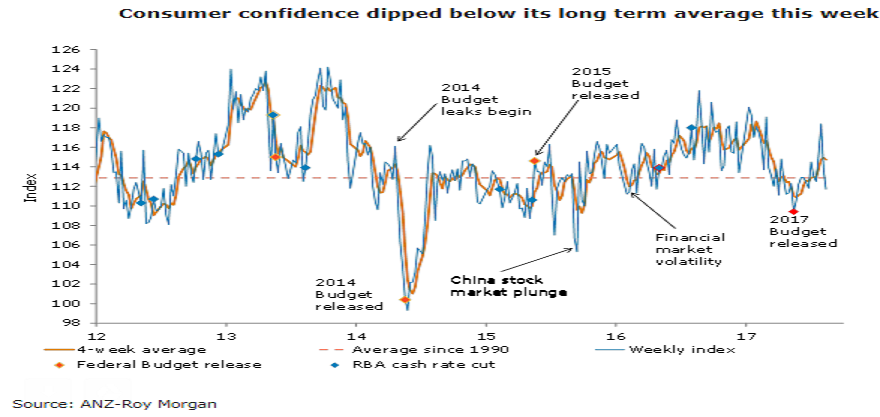

ANZ-Roy Morgan Australian Consumer Confidence fell again this week, the headline index dropping by 1.8 percent from last week to 111.7 and below the long term average of 112.9. Three out of the five sub-indices posted declines, with the sharpest fall in current economic conditions.

Consumers’ sentiment towards current economic conditions remained sombre, with a fall of 6 percent coming straight after the prior week’s sharp decline of more than 10 percent. In contrast, the measure of future economic conditions was up touch to 105.1, just above the long term average for the first time since March.

Attitudes toward current financial conditions fell 2 percent, largely reversing the previous week’s improvement. On the flipside, views towards future financial conditions were up 1.9 percent but are still below the long-run average – if only just.

The ‘time to buy a major household item’ fell a 3.0 percent last week and is now well below its long-run average. Inflation expectations edged up to 4.6 percent, a third consecutive weekly rise. The four week moving average stayed at 4.4 percent.

"In terms of the most recent move it is possible that the increased tensions around North Korea may have impacted sentiment. More broadly, we think it will be difficult for consumer confidence to sustain any material rise until we see a lift in wage growth. Especially when we consider the high debt levels of households and the pressures they are facing from rising energy costs, among other things," said David Plank, Head of Australian Economics, ANZ Research.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off