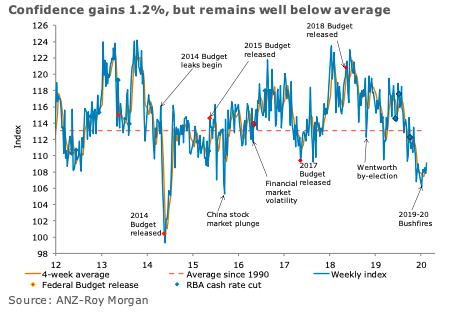

Australia’s ANZ-Roy Morgan consumer confidence gained 1.2 percent last week, more than reversing last week’s loss and continuing the recent sawtooth pattern. The gains have been a little more than the losses, so the index reached its 2020 high last week.

‘Current finances’ gained 2 percent last week, while ‘future finances’ were marginally down by 0.1 percent. ‘Current economic conditions’ registered a healthy gain of 6.5 percent compared to a fall of 4.1 percent seen last week, while ‘future economic conditions’ were flat.

‘Time to buy a major household item’ fell 0.9 percent, adding to the loss of 5 percent seen in the previous reading. The four-week moving average for ‘inflation expectations’ fell by 0.1ppt to 4.0 percent, while the weekly reading remained stable.

"The ANZ Roy-Morgan Australian Consumer Confidence index has risen to its highest level in 2020, with sentiment possibly buoyed by the continued gains in asset prices. The fact the coronavirus hasn’t become established in Australia might be a contributing factor, although the measures taken by the Government to help ensure this remains the case will have economic consequences. This week the key domestic influences on sentiment will be wage and employment data. We aren’t expecting the news to be flash, which may see confidence dip over the coming week and so continue the up and down behaviour seen in recent weeks," said David Plank, ANZ’s Head of Australian Economics.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022