After a surprise rise in Q1, Australia’s CAPEX is forecast to decline in Q2, driven by falling mining investment. It’s not all bad news though, with one of the building blocks for GDP, plant and equipment investment, expected to post solid growth, while overall non-mining capex is likely to rise solidly.

Q2 CAPEX is expected to fall 0.8 percent q/q in Q2, more than reversing the rise in Q1. This decline is likely to be driven by falling buildings and structures spending, with ongoing weakness in the mining sector, especially in Western Australia, likely to weigh on the overall result, ANZ Research reported.

There is some risk around this result, given the potential impact of the Prelude floating LNG plant. The vessel departed Korea bound for Australia in late June, but the RBA noted in the August Statement on Monetary Policy that strength in mining investment earlier in the year “predominantly reflected earlier-than-expected prepayments on existing projects”. Variations in the timing of these payments may cause some further volatility to the mining figures in both the CAPEX and national accounts data.

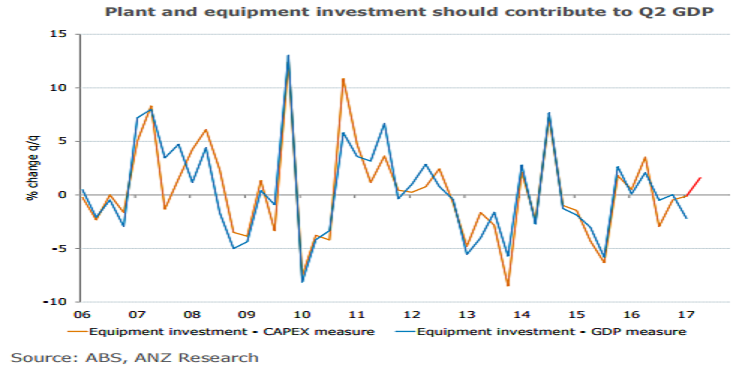

Aside from this temporary factor, the most important part of the Q2 result is spending on plant and equipment investment as it will flow directly into the Q2 GDP result. P&E investment likely rose by 1.6 percent q/q, in line with solid capital goods imports in the quarter.

In particular, non-mining CAPEX is expected to be revised higher to AUD65bn, from AUD56.9bn. This implies a modest rise of 1 percent y/y – a welcome improvement from the two previous years of decline.

"We also expect firms will upgrade their investment plans for 2017-18, in line with the strength in business conditions. While the drag from the mining sector still has a bit further to run, the transition to other parts of the economy is well underway," the report commented.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination