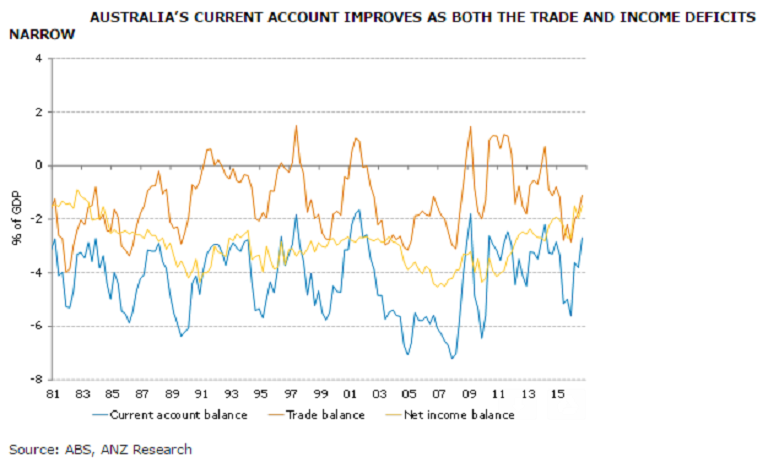

Australia’s current account deficit narrowed sharply in Q3, underpinned by a strong pickup in export prices and an improvement in the net income deficit. Net exports subtracted 0.2ppts from GDP growth. With commodity prices increasing the trade deficit is forecast to narrow further in Q4.

Australia’s current account deficit (CAD) narrowed to 2.7 percent of GDP from an upwardly revised 3.8 percent in Q2 2016. The improvement was driven by a narrowing of the trade deficit to AUD4.7 billion from AUD7.4 billion in Q2 2016 as well as an improvement in the net income deficit (from 2 percent of GDP in Q2 to 1.5 percent in Q3).

The volume of exports ticked 0.3 percent higher in Q3, underpinned by a strong rise in services exports volumes (+2.4 percent q/q), while manufacturing and resource exports both declined. The weakness in resource exports (-0.1 percent q/q) was driven by iron ore, while other mineral fuels and metals were also down. Coal (+2.6 percent) and non-monetary gold (+7.4 percent) exports rose. Rural exports volumes were also higher.

In addition, export prices rose by 3.4 percent q/q in Q3, the largest quarterly increase since mid-2013, driven by the recent rally in commodity prices. As a result, the value of exports rose by 3.7 percent q/q – which is the highest quarterly increase since September last year.

Import volumes rose 1.3 percent q/q in Q3, with strength in capital and intermediate goods imports. Consumption goods imports fell sharply (down 3.3 percent q/q in Q3) and more than reversed the increase over the previous quarter. The weak reading for consumption goods imports is to some extent consistent with the softer tone for retail sales volumes in Q3.

"Overall, the terms of trade rose 4.4 percent in Q3 after a 2.3 percent increase in the previous quarter. We expect the term of trade to continue to strengthen in Q4 supported by the rally in commodity prices," ANZ Research commented in its recent report.

Meanwhile, the AUD/USD is trading bearish at 0.74, down 0.32 percent, while at 6:00GMT, the FxWirePro's Hourly AUD Strength Index remained neutral at -47.77 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility