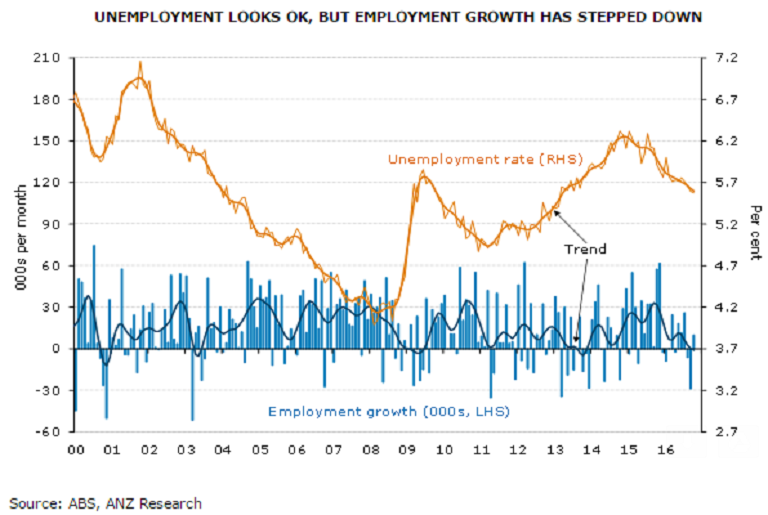

Employment change in Australia snapped 2-month fall during the period of October, while the jobless rate held steady at 3-year low. However, the change in employment remained sharply below market expectations, signaling that the labor market has yet not fully recovered from early lows. We expect AUD/USD to remain bullish following the rebound in employment statistics.

Australia’s employment rose by 9,800 in October in seasonally adjusted terms, missing expectations for an increase of 20,000, data released by the Australian Bureau of Statistics showed Thursday. However, the rate of unemployment remained steady at 5.6 percent, while the participation rate slightly declined to 64.4 percent, from 64.5 percent in September.

Full-time employment soared by 41,500, almost completely reversing the decline reported in September; part-time employment plunged by 31,700. Both male and female part-time employment fell, posting declines of 12,800 and 19,000 respectively.

On a gender-basis, the unemployment rate fell to 5.52 percent for males, registering the lowest level since February 2013, while that among females remained unchanged at 5.64 percent. Further, labor force participation held steady at 64.4 percent, courtesy of a downward revision to the September figure which was previously reported at 64.5 percent.

The employment report remains a major indicator for the policy moves by the Reserve Bank of Australia (RBA) and the November jobs data will be eyed closely before the next monetary policy meeting scheduled to be held in mid-December.

Meanwhile, AUD/USD has broken the yesterday’s level of 0.750 and at 5:10 GMT, AUD/USD was trading 0.01 percent down at 0.7477, while the FxWirePro's Hourly AUD Strength Index stood neutral at -40 (higher than the -75 benchmark for bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility