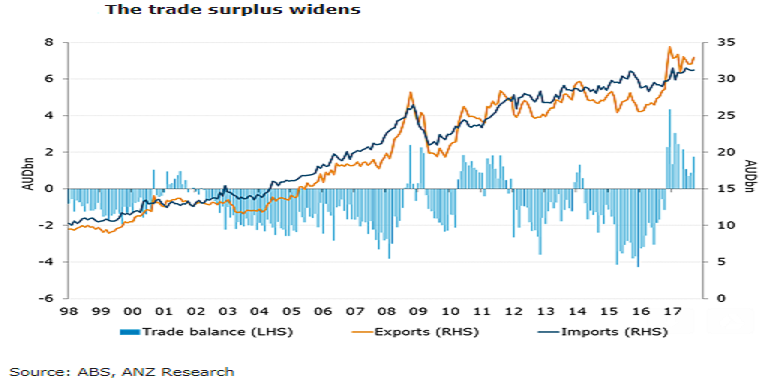

Australia’s net exports are expected to add 0.3ppts to third quarter real GDP growth, according to the latest report from ANZ Research. The country’s trade surplus widened in September to AUD1,745 million from a downwardly revised AUD873 million the previous month.

The improvement in the trade position was led by a rise in export values – up 2.9 percent in September. Metal ores and minerals (+8 percent m/m) and services (+1.4 percent m/m) were the main contributors to the acceleration in export growth.

Resources ex-nonmonetary gold saw the fastest increase in the month (+3.8 percent m/m). The strength in metal ores and mineral (+8 percent m/m) offset declines in coal (-0.3 percent m/m) and other mineral fuels (-1.2 percent m/m). Encouragingly, service exports (up AUD102 million) continued to strengthen, growing 1.4 percent m/m.

Import values were steady for the second straight month in September. Imports of intermediate goods and services both fell in the month, down 0.4 percent (AUD35 million) and 1.3 percent m/m (AUD97 million), respectively. Imports of consumption goods grew, after declining in the prior two months, increasing AUD191 million (+2.4 percent m/m).

However, capital goods imports improved (+0.9 percent m/m), likely reflecting the strong pipeline of infrastructure projects. Service imports were a drag as they fell AUD97 million (-1.3 percent m/m).

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure