AUD/USD has fallen more than 25% since it traded above parity at 1.05 against the dollar on April 2013. The pair is currently trading at 0.78 level. We believe this trend to continue despite any short term revamp.

The Australian economy has faced several windfalls since namely the slowdown in china, its biggest commodity trading partner.

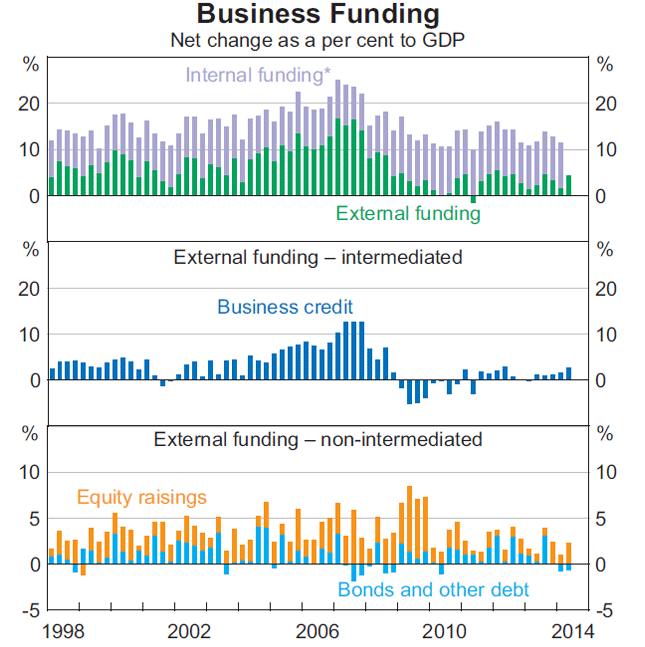

Today we thought to take a look at the domestic sector and growth in credit. We see from the latest data & charts by Reserve Bank of Australia-

- The Australian economy is suffering from a business funding slack. Funding has a long way ahead to reach to the pre-crisis level.

- Business funding growth through especially intermediaries is lacking a lot. Currently this channel provides around 3% compared to 12% before 2008 financial crisis.

This slack in the domestic economy reiterates our view of a sluggish Australian economy, which might prompt the Reserve Bank of Australia to cut rates further.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?