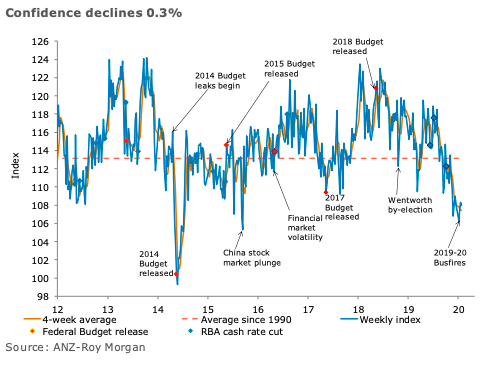

Australian ANZ-Roy Morgan consumer confidence declined 0.3 percent last week, after two straight weekly gains.

‘Overall financial conditions’ was flat, as a decline of 0.5 percent in ‘current finances’ was balanced by a similar increase in future finances.

‘Current economic conditions’ fell 1.8 percent, while ‘future economic conditions’ gained 3.5 percent last week.

‘Time to buy a major household item’ was down 2.4 percent compared to a gain of 4.7 percent previously. The four-week moving average of ‘inflation expectations’ was stable at 3.9 percent.

"Confidence declined modestly last week, despite the strong employment number. The news flow around the coronavirus and the potential implications for Chinese and Australian growth likely acted as a material offset to the more positive local news. There are a number of unusual influences on sentiment at present, such as the bushfires and coronavirus and the offsetting impact of strength in the labour market. This makes it more difficult than usual to assess how consumer spending will respond. We think this difficulty will see the RBA opting to wait for more information before it considers a further reduction in the cash rate," said David Plank, ANZ’s Head of Australian Economics.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility