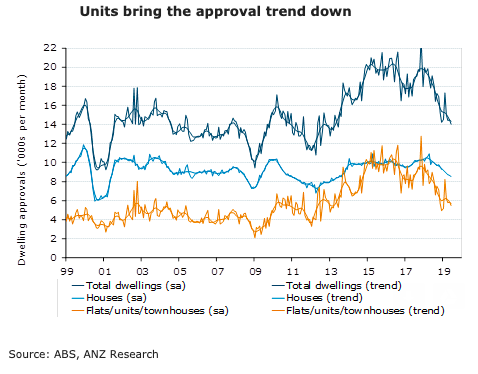

Australia’s building approvals were down 9.7 percent over July, driven by an 18.4 percent fall in units and a smaller 3.3 percent fall in houses, marking the third lowest annual result in both the last year and the last decade.

Further, a sharp reduction in unit approvals, led by Sydney and Melbourne, may be a sign that quality concerns are having an impact on apartment supply, according to the latest report from ANZ Research.

Private sector house approvals were down 3.3 percent m/m, wiping out modest gains in June and are now down 16.6 percent y/y. House approvals have fallen an average of 1.5 percent per month for the last year, with only three months where growth was positive.

Victoria and New South Wales had very weak monthly approvals results ( −17.5 percent and −24.3 percent m/m respectively), driven by falls in unit approvals of more than 40% in each state.

Meanwhile, Queensland, South Australia and Western Australia saw bumps in approvals through July, concentrated in unit growth. In annual seasonally adjusted terms, major states saw approvals fall (−36.9 percent y/y NSW, −25.8 percent Victoria, −22.3 percent Qld) driven by units, while South Australia saw a substantial rise (28.9 percent y/y).

The renewed decline in unit approvals in the last couple of months, concentrated in the “investor states” of New South Wales and Victoria, may reflect quality concerns in some large apartment developments.

The value of non-residential approvals weakened in July (-9.9 percent m/m), wiping out most of the gain in June (10.5 percent m/m). This is likely to reflect short-term volatility in approvals. Trend growth in non-residential approvals is filling some of the gap left by the weaker housing sector, the report added.

"Credit easing following APRA changes in July and rate cuts in June and July may flow through to approvals eventually, although the renewed downward trend in unit approvals after a short-lived stabilisation poses a risk to our outlook," ANZ Research further commented in the report.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains