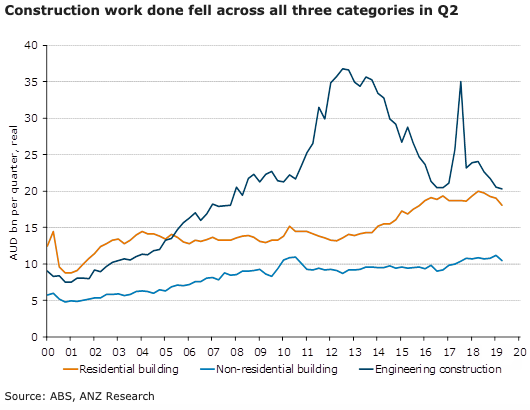

Australia’s construction work done fell for a fourth consecutive quarter in Q2. The contraction in residential activity accelerated, non-residential building activity dropped across both private and public sectors, and the weakness in engineering construction persisted, with only a small uptick in public sector work done, according to the latest report from ANZ Research.

Construction activity in Australia fell 3.8 percent q/q in Q2 2019 to be down 11.1 percent y/y. This was the fourth (and largest) quarterly contraction in a row. The decline in residential construction worsened to -5.1 percent q/q, dragging the annual result down to -9.6 percent. Non-residential building saw an even larger fall of 6.6 percent q/q and engineering construction rounded off the trifecta, down 1.1 percent q/q.

After two quarters of disappointing results, public engineering construction eked out a 0.9 percent gain in Q2. However, it remains 16.1 percent down from the peak a year ago despite the solid pipeline of infrastructure projects. Public non-residential building dropped a further 4.9 percent q/q, following the 2.9 percent fall in Q1.

New building (-5.3 percent) and alterations and additions (-3.3 percent) combined to drag down private residential activity to its lowest level since late 2015. Private engineering construction has not yet bottomed out, falling 2.5 percent q/q, while private non-residential building lost all of the gains from Q1 and then some, down 7.3 percent q/q.

Western Australia (+1.4 percent q/q) was the only state to see a rise in construction, driven by a 2.1 percent q/q increase in engineering construction along with smaller improvements in residential and non-residential building. Queensland (-6.0 percent) recorded the largest decline in construction activity followed by South Australia (-4.8 percent), Victoria (-4.4 percent), Tasmania (-4.1 percent) and New South Wales (-1.9 percent).

"The sharper-than-expected fall in construction activity during the quarter will undermine GDP growth in Q2 2019 and puts downside risk on our pick," the report further commented.

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility