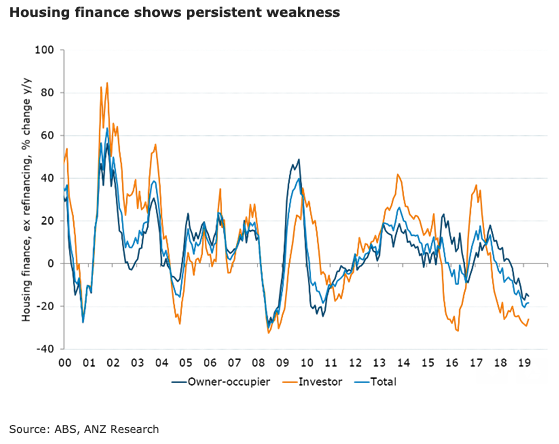

Australia’s all categories of housing finance posted sharp losses and were below market expectations. Owner-occupier finance was hit hardest, although this may be a correction to last month’s spike of owner-occupier finance, which was the highest monthly gain since August 2017.

The monthly loss of investor finance result is about average for the last year, while the annual result is the 13th consecutive decline of 20 percent or more.

The value of housing finance fell by 3.2 percent m/m in March, more than reversing the gain seen in February. After last month’s bounce, a fall was not surprising, although the magnitude of the loss was larger than expected. The y/y decline slowed marginally, though, from -20.3 percent in January, -18.6 percent in February to -18.4 percent in March.

The value of finance for owner-occupiers fell sharply, but first home buyer finance is still growing. The 3.4 percent m/m loss for owner-occupiers led to a weak yearly result of -15.2 percent. This is the third-lowest y/y result since 2010 (the lowest two occurred in December 2018 and January this year). Finance for first home buyers grew m/m for the fifth time in the last six months, at 0.6 percent m/m in value terms.

Meanwhile, investor finance is still falling quickly. The annual loss in investor finance has been at least 20 percent each month since February 2018. However, the annual result was the smallest decline in 2019 so far.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal