Australia’s labour market data for the month of April remained mixed across all sectors, with the employment index rising, although downward revisions to March and February and a tick back up in the unemployment rate took the gloss off the report.

Employment rose 22.6k in April, following a downwardly revised fall of 0.7k in February (initially reported as 4.9k). Further, the unemployment rate ticked back up from 5.5 percent to 5.6 percent alongside an increase in the participation rate from 65.5 percent to 65.6 percent.

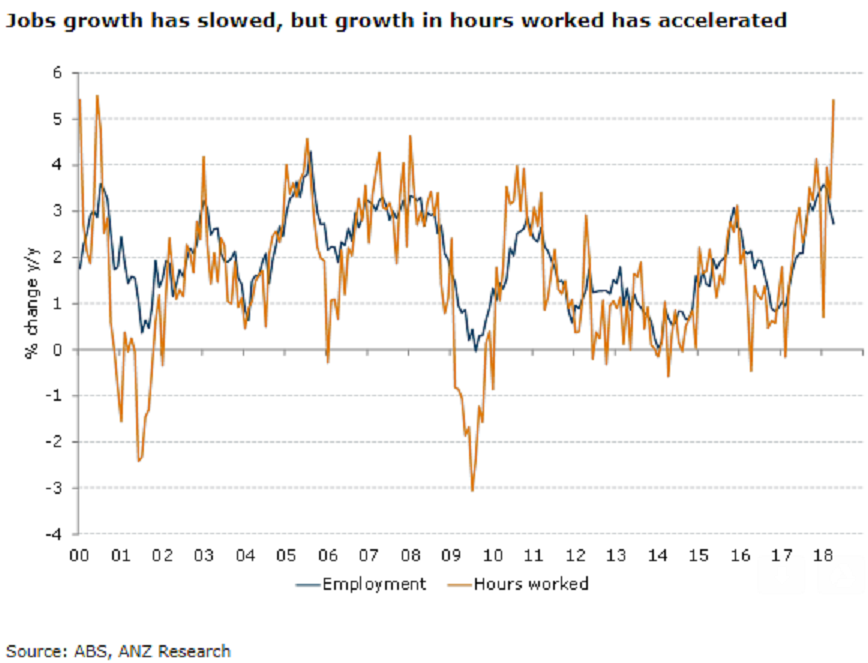

In addition, full-time jobs bounced 33k, and part-time jobs fell 10k. Alongside the strength in full-time jobs, hours worked rose 1.1 percent. In fact, while employment grew just 0.1 percent in the three months to April, hours worked rose a much stronger 2.8 percent.

"While labour market leading indicators are a little more mixed now, we remain confident that the outlook for the labour market remains solid. Also, our ANZ Labour Market Indicator continues to suggest that further tightening of the labour market is likely over the next few months," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target