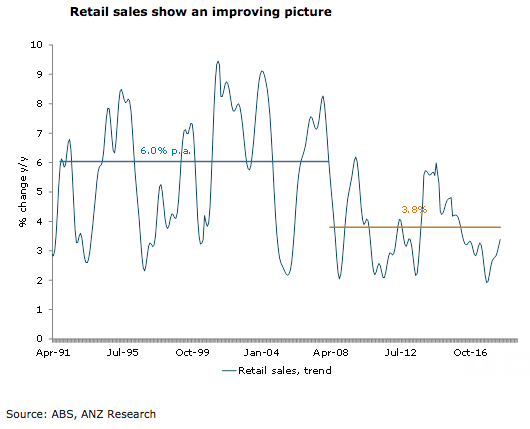

Australia’s retail sales bounced back during the month of August, with the strength broadly based across the country and across categories. While this is consistent with ANZ-Roy Morgan consumer confidence, which continues to track above its long run average, it is somewhat surprising in the face of falling house prices, rising petrol prices and ongoing retail price deflation.

Retail sales bounced back, rising 0.3 percent m/m in August after a flat outcome the previous month, which pushes annual growth up to 3.8 percent y/y, the fastest pace since May 2017. In three month end annualised terms, retail sales are up a solid 5.3 percent.

The strength in sales was broadly based across the country and across categories. Sales rose in every state except the Northern Territory, and were particularly strong in New South Wales (+0.5 percent m/m), South Australia (+0.7 percent m/m) and Tasmania (+0.6 percent m/m). Sales in New South Wales and Victoria remain very solid, up 4.3 percent y/y and 5.9 percent y/y respectively.

Food sales were flat in August, while every other category recorded a rise. This was led by department store sales (+0.9 percent m/m), with strong growth also in clothing & footwear (+0.8 percent m/m) and cafes, restaurants & takeaway (+0.7 percent m/m).

Household goods sales rose a more modest 0.2 percent m/m, but this was weighed down by a 0.5 percent fall for electrical and electronic goods sales. Furniture, floor covering, houseware and textile goods sales were up a solid 1.1 percent.

Adding to the positive tone, large store sales – which tend to be less volatile given the data is enumerated rather than survey based - rose 0.5 percent m/m, to be 5 percent higher over the year, while small store sales fell by 0.1 percent m/m (to be up 1.2 percent y/y). Online retail sales continue to gain share, accounting for 5.6 percent of sales in August, up from 4.6 percent a year ago.

"Given we see consumer spending as a key risk to the economic outlook, the current resilience in household spending – despite the various headwinds - is encouraging and sets a solid base for Q3 consumption," ANZ Research commented in its latest report.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength