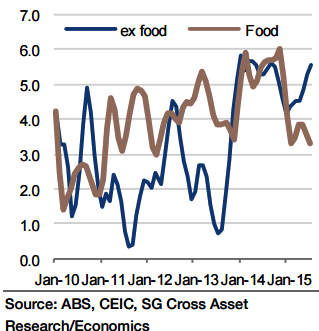

Australia's recent retail sales data were definitely on the soft side, with average monthly gains of 0.2% over the five months to July, which is exactly half the average pace recorded in 2013/14. This weakness stems in substantial part from a supermarket price war which has depressed nominal growth in this segment, non-food sales have accelerated.

"The intense downward pressure on food prices is expected to have abated, but not reversed, in August, which would help retail sales growth to improve towards its medium-term trend. However, a number of developments in other branches of the retail trade are likely to contain growth, clothing sales growth has surged recently (it was up 8.6% yoy in July) to a rate which might not be maintained, and some pull-back is likely", says Societe Generale.

Similarly, sales of household goods have been soaring over the past year or so, largely on the back of the booming housing market. While the level of sales are expected to remain high, the growth rate is likely to moderate from July's 8.6% yoy (same as clothing).

"Moreover, for some months, growth in nominal retail sales was so far above nominal disposable income growth (3.3% yoy in Q2) that some moderation seems unavoidable. Rising retail sales to tourists are part of the story, a factor that is very unlikely to disappear in the near term", says Societe Generale.

Australian supermarket price war effect likely to fade

Monday, September 28, 2015 7:00 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022