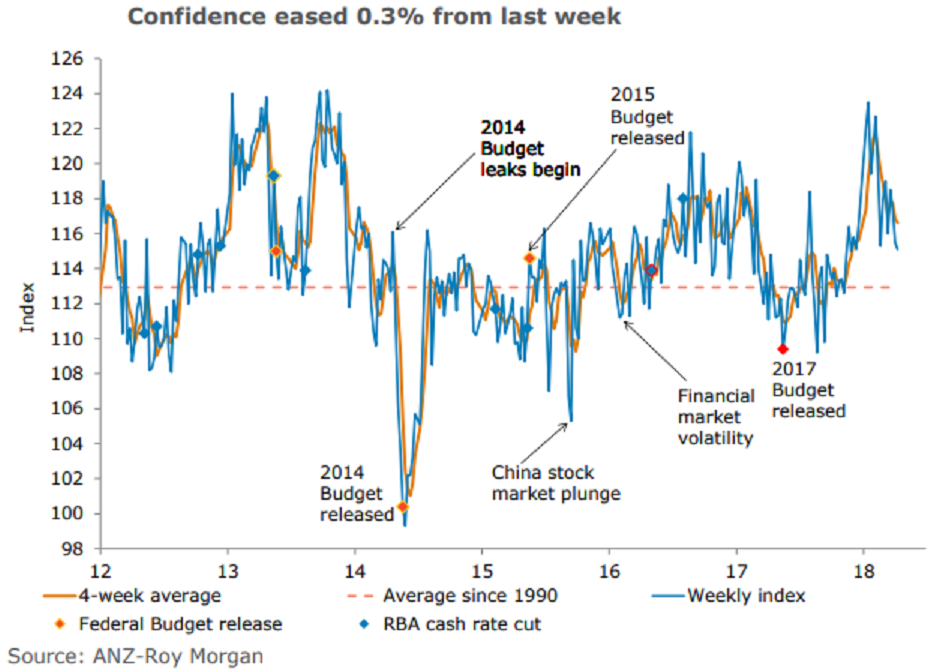

Australia’s ANZ Roy Morgan Consumer confidence eased for the third successive week as the latest reading fell 0.3 percent to 115.1. The underlying details were mixed, with two out of five sub-indices registering declines.

The drag came from views towards current and future financial conditions which continued the decline from last week, falling 1.5 percent and 3.4 percent respectively. Despite the drop, the four-week moving average of aggregate financial conditions remains comfortably above its long-run average.

Sentiment toward current economic conditions rose marginally by 0.9 percent after a similar 0.7 percent rise the previous week. Future economic conditions recovered some of the 1.1 percent loss posted last week to rise 0.7 percent in the latest reading.

The 'time to buy a household item' rose 1.5 percent this week, partially unwinding the previous week’s 3.6 percent slump. Inflation expectations edged down to 4.4 percent on a four-week moving average basis.

"We believe global news has dictated sentiment around economic sentiment, while more fundamental factors such as continued employment growth have helped maintain confidence in financial conditions," said David Plank, Head of Australian Economics, ANZ Research.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination