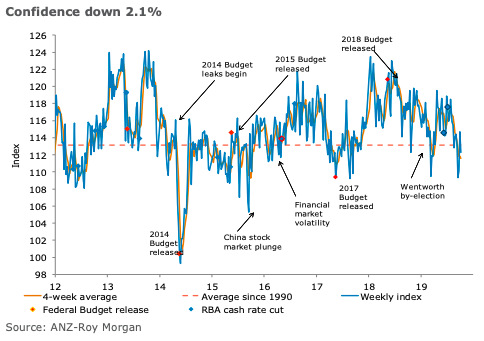

Australia’s ANZ-Roy Morgan consumer confidence fell 2.1 percent last week after gaining 4.2 percent in the previous reading. All the sub-indices fell except the ‘time to buy a major household item’.

Financial conditions sub-indices were down significantly and have been volatile for the last few weeks. Current finances were down 4.7 percent while future finances lost 5.0 percent.

Current economic conditions fell 1.7 percent, while future economic conditions lost 1.1 percent after gaining 4.2 percent in the previous reading.

‘Time to buy a household item’ continued to recover after falling to a 10-year low in recent weeks, although it remains below its long term average. Inflation expectations inched higher by 0.1 ppt to 4.1 percent.

"Last week’s bounce in ANZ-Roy Morgan consumer confidence wasn’t sustained and sentiment is now back below the long term average. Ongoing concerns about the medium term outlook are weighing down sentiment, although consumers continue to feel okay about their current financial circumstances. This divergence in thinking possibly explains the modest bounce in retail sales reported last week: consumers recognise the impact of tax and interest rate cuts on their budgets, but are worried about the outlook, and so unwilling to splash the cash. The RBA is likely to be disappointed about the inability for either confidence or spending to lift materially despite significant monetary and fiscal stimulus," said Felicity Emmett, ANZ’s Senior Economist.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength