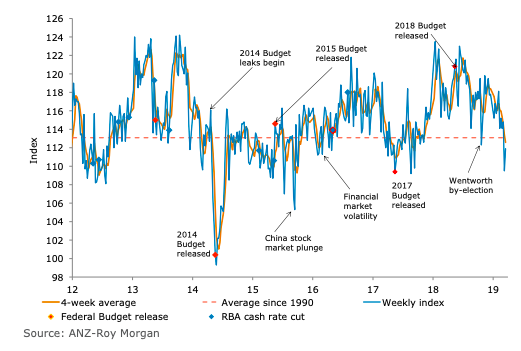

Australia’s ANZ-Roy Morgan consumer confidence lifted by 2.2 percent after a fall of 4.6 percent last week. The index is still below the long term average of 113.1.

Current financial condition jumped by 6 percent; the increase comes after the falls in the previous three readings. Future financial conditions were also up by 1.7 percent. Current economic conditions were up 4.8 percent after the sharp fall of 7.9 percent last week.

Future financial conditions were up marginally by 0.1 percent. The ‘time to buy a household item’ fell by 0.5 percent, its third consecutive fall. Four-week moving average inflation expectations were stable at 4 percent.

"The weekend just past was overshadowed by the tragic events in Christchurch on Friday. This makes it very difficult to offer any firm conclusions about the partial recovery in confidence after the prior weekend’s sharp decline," said David Plank, ANZ’s Head of Australian Economics.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions