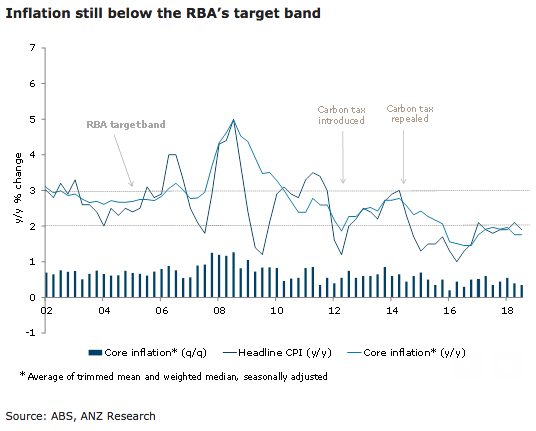

Australia’s consumer price inflation (CPI) data for the third quarter of this year missed market expectations, albeit remaining unchanged from that in the previous quarter. However, the ANZ Diffusion Index is consistent with core inflation being weighed down by the one-off changes to some administered prices, as forewarned by the Reserve Bank of Australia (RBA) in the August Statement on Monetary Policy.

Encouragingly, domestic market services inflation accelerated in Q3, suggesting that these prices are responding to the pick-up in unit labour cost growth. This is important for the inflation outlook given the weakness in housing and administered inflation as well as ongoing retail price competition.

As expected, Q3 CPI was weak, with headline CPI rising 0.4 percent q/q (below market expectations but in line with ANZ’s forecast), and decelerating in annual terms to 1.9 percent y/y from 2.1 percent.

The introduction of the new ChildCare Subsidy had a significant effect, with childcare prices falling 11.8 percent q/q, taking 0.2ppts off headline CPI. Alcohol & tobacco, housing, petrol each added 0.1 ppts, while international airfare prices rose sharply with holiday travel and accommodation adding 0.2ppts.

Core inflation was also weak, with the average of the two measures rising by 0.32 percent q/q (below market expectations, but broadly in line with our forecasts). There were also downward revisions to both measures for Q2, to 0.4 percent q/q from an initially reported 0.5 percent q/q.

As a result, core inflation is running at just 1.5 percent in six month end annualised terms, the weakest result since September 2016. CPI ex-volatiles (which includes childcare) – a third measure looked at by the RBA – was very weak, rising just 0.1 percent q/q.

"Our preliminary CPI forecast for Q4 2018 is for headline inflation to rise by 0.6 percent q/q," ANZ Research commented in its latest report.

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns