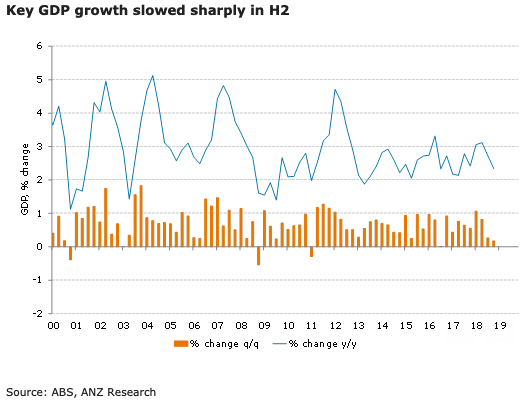

Australia’s gross domestic product (GDP) for the last quarter of 2018 slowed to 0.2 percent q/q and 2.3 percent y/y. Looking at Q3 and Q4 together shows that annualised growth in the second half was 0.9 percent, a sharp step down from 3.8 percent in H1, with a notable softening in the household sector.

Also, the result is significantly weaker than the RBA’s forecast of 2.8 percent y/y published in the February Statement on Monetary Policy, ANZ Research reported.

Q4 growth was also held down by weak exports, farm output and mining investment, while public spending and non-mining business investment were the bright spots. Housing construction fell 3.4 percent q/q, while household consumption was up just 0.4 percent q/q.

In contrast, the business, public and export sectors look solid. Non-mining investment rose a strong 2.4 percent q/q and expectations remain for further solid growth.

Public spending rose 1.5 percent q/q and is likely to continue to contribute to growth given a large pipeline of state-backed infrastructure spending and the rollout of the National Disability Insurance Scheme.

"The key uncertainty continues to be around the outlook for consumer spending in an environment of persistently low wages growth, and falling house prices. While household income is slowly picking up, households look to be realising that income growth will not rise to the pace that we saw last decade, and spending will need to grow more in line with income," ANZ Research commented in its latest report.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination