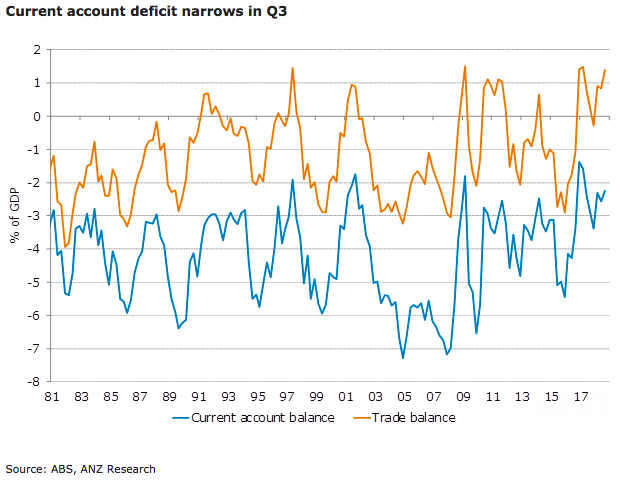

Australia’s current account deficit narrowed during the third quarter of this year, driven by an improvement in the trade balance offsetting a deterioration in the income balance. Net exports made a slightly larger-than-expected contribution, due to a fall in import volumes.

The country’s CAD narrowed to AUD10.7 billion from a revised estimate of AUD12.1 billion in Q2 (originally AUD13.5 billion). This equates to 2.2 percent of GDP, from 2.6 percent in Q2.

An improved trade balance drove the decrease, coming in at a surplus of AUD6.6 billion compared to AUD3.9 billion in Q2. This offset a deterioration in the income balance to a deficit of AUD16.9 billion (from a deficit of AUD15.8 billion in Q2). That equates to 3.6 percent of GDP, the highest since Q2 2011.

Net exports will make a solid contribution to Q3 GDP. The 0.4ppt they are adding is the highest since Q1 2016 and slightly above consensus. Exports volumes rose by 0.1 percent q/q led by a 4.5 percent increase in services. Resource exports were a drag, falling 1.5 percent, while rural goods increased 0.5 percent and manufacturing goods increased 2.1 percent.

Import volumes fell 1.5 percent q/q with a 2.5 percent drop in consumption goods and 2.2 percent fall in capital goods driving the decline. Within these categories, automobiles fell 3.9 percent and machinery and equipment declined 4.2 percent. Intermediate and other goods rose 0.2 percent, while service imports were virtually unchanged. The terms of trade rose by 0.8 percent q/q, and 2.7 percent y/y.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX