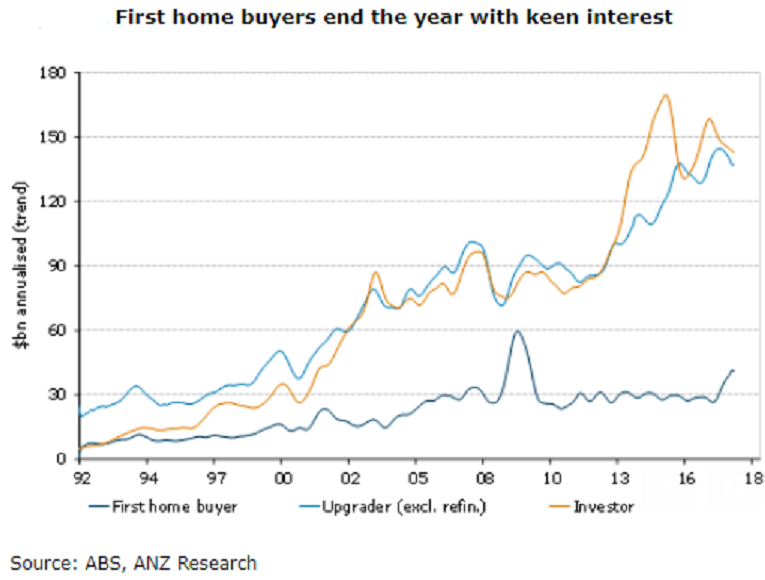

Australia’s housing finance approvals fell in December, with both owner-occupier and investor lending down in the month. Some softening in housing finance is consistent with the broad cooling in the housing market seen in late December.

The value of housing finance commitments retraced the previous two months’ gains, falling 2.5 percent m/m in December. Total finance is now 2.2 percent lower than a year ago, the first negative annual growth rate since August 2016. In trend terms, though, housing finance is down just 0.5percent y/y.

Both owner-occupier and investor lending fell in the month. The value of housing finance for investors fell 2.6 percent m/m in December, to be 10.5 percent lower over the year. In three month end annualized terms, however, the worst now appears behind us in terms of the slowdown in investor finance.

Owner occupier finance also fell, down 2.3 percent m/m in December, but this followed a strong 1.7% bounce the previous month, with approvals still up 5.6 percent y/y.

Finance for first home buyers slipped a touch in December (-1.4 percent m/m) but has stabilized at much higher levels than seen in recent years. Indeed, finance for first home buyers is still up 35 percent y/y and accounted for 11.7 percent of total finance.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns