Australia’s private new capex contracted for a second consecutive quarter in Q2, as a rise in machinery and equipment was more than offset by a drop in buildings and structures. It wasn’t all bad news, though, with mining recording its strongest quarterly result in five years, according to a report from ANZ Research.

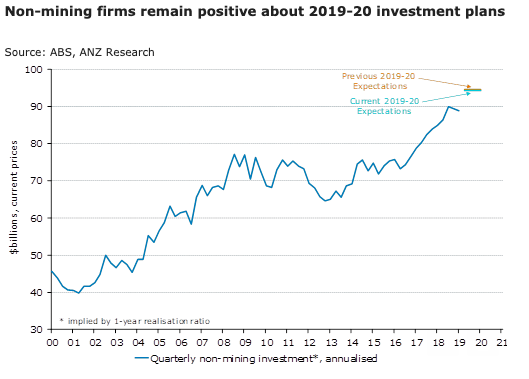

Furthermore, businesses upgraded their 2019-20 capex intentions by more than anticipated, planning an annual increase of 10.7 percent.

Mining recorded its strongest quarterly capex growth in five years of 1.7 percent q/q and manufacturing bounced back from two quarters of decline, posting an 8.5 percent rise.

For 2019-20, capex plans were upgraded to AUD113 billion in Q2 from AUD99 billion in Q1. Part of this reflects the fact that businesses almost always upgrade their intentions at this time as the current financial year is underway.

Meanwhile, both non-mining (+6 percent) and mining firms (+20 percent) are planning stronger investment during 2019-20. Coal and iron ore investment continues to build while oil and gas capex is expected to bottom out soon, the report added.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals