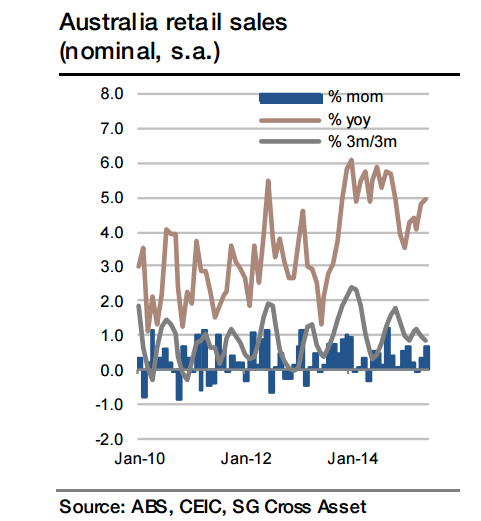

Australia's retail sales surprised on the upside in June with a 0.7% mom gain, despite a marginal (0.1%) decline in food sales, meaning that non-food sales jumped by 1.2% mom, their largest gain since January (food sales account for just over 40% of the total). Given the moderate gains in disposable income (2.6% yoy in Q1), retail sales growth of just short of 5% is unlikely to be sustained for long.

Hence, a moderate pull-back is expected in July non-food sales (-0.1% mom), which combined with a 0.5% rebound in food sales, implies a marginal 0.1% mom gain in overall sales. The weakness is likely to be concentrated in sales of household goods, which have seen an impressive run over the past year, partly on the back of the housing boom. One key downside risk comes from department store sales, which have in recent years seen dramatic volatility in July/August (with steep declines in July and August rebounds), though this did not occur in 2014.

Australia's retail sales consolidating after autumn surge

Monday, August 31, 2015 1:53 AM UTC

Editor's Picks

- Market Data

Most Popular

Wall Street Futures Tumble as U.S.-Iran Conflict Escalates and Oil Prices Surge

Wall Street Futures Tumble as U.S.-Iran Conflict Escalates and Oil Prices Surge  Gold Prices Surge Over 2% After U.S.-Israel Strikes on Iran Spark Safe-Haven Demand

Gold Prices Surge Over 2% After U.S.-Israel Strikes on Iran Spark Safe-Haven Demand  Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement

Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement  China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump

China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Asian Currencies Slide as US-Israel Strikes on Iran Trigger Oil Surge and Risk-Off Rally

Asian Currencies Slide as US-Israel Strikes on Iran Trigger Oil Surge and Risk-Off Rally  Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade

Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade  PBOC Scraps Forex Risk Reserve as Yuan Rally Pressures Chinese Exporters

PBOC Scraps Forex Risk Reserve as Yuan Rally Pressures Chinese Exporters  Bank of Japan Signals Further Interest Rate Hikes as Inflation Trends Toward 2% Target

Bank of Japan Signals Further Interest Rate Hikes as Inflation Trends Toward 2% Target  Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran

Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran  ASX CEO Exit Signals Turbulent Transition Amid Lawsuit and Regulatory Scrutiny

ASX CEO Exit Signals Turbulent Transition Amid Lawsuit and Regulatory Scrutiny  Australia Housing Market Hits Record High Despite RBA Rate Hike

Australia Housing Market Hits Record High Despite RBA Rate Hike