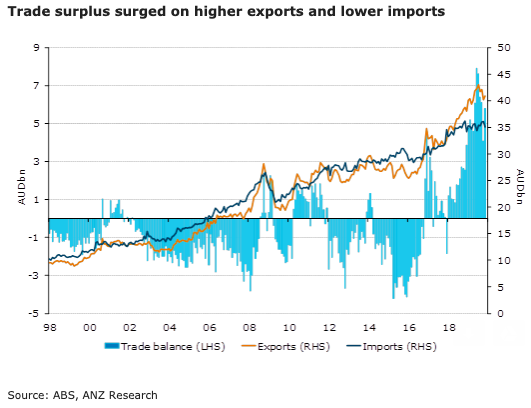

Australia’s trade surplus surged to AUD5.8bn in November, well above our and market expectations. The rise in the trade surplus was from a combination of higher exports and lower imports, up 1.8 percent m/m and down 2.8 percent m/m respectively. Stronger resources and services exports drove most of the increase.

By our reckoning, the stronger resource export figure reflects an increase in volume. Imports on the other hand were down, with a particularly sharp decline in consumption goods. This decline is further indication that household spending is subdued.

Total resource exports rose 0.9 percent m/m in November and are now 3 percent higher than a year ago. The increase largely reflects higher iron ore exports, which rose 2.1 percent m/m, as well as LNG, up 0.9 percent m/m. These rises were partially offset by a sharp decline in non-monetary gold, which fell 6 percent m/m, continuing the strong decline in the previous month.

The RBA’s commodity price index was down 3.8 percent in November, which suggests that the rise in resource exports was likely due to a rise in volume. Manufacturing exports had a soft month, down 0.3 percent m/m, which follows the large rise in the previous month. Service exports continued to rise, up 1.1 percent m/m, leaving them 8.9 percent higher than a year ago.

Consumption imports fell 6.6 percent m/m, leading the fall in imports. A large part of this was driven by a 20.7 percent m/m decline in car imports, which are now down over 19 percent y/y. The capital goods imports figure was the other large fall for the month, declining 3.9 percent m/m. Fuel imports were down 4.9 percent m/m, largely reversing the sharp rise the previous month.

"Looking forward to last December’s trade balance figures and the next two quarters, we will be looking for any impact from the bushfires on tourism-related expenditure," ANZ Research commented in its latest report.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran