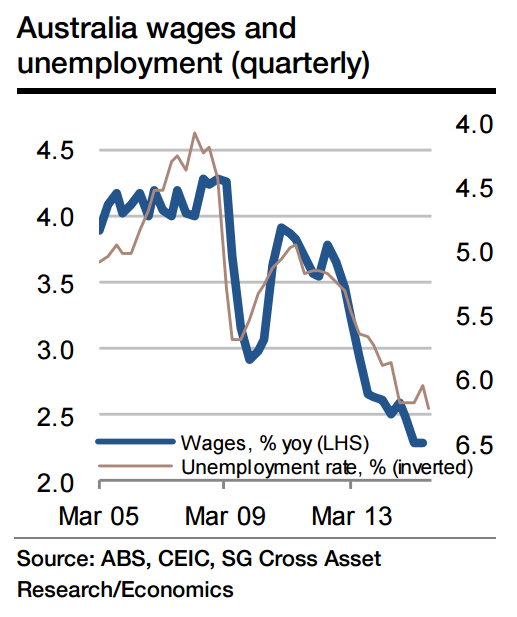

As unemployment in Australia started to rise in late 2012, wage growth slowed. By the start of this year, annual wage growth (excluding bonuses) had declined to 2.3%, the lowest in the series' - admittedly fairly short - history (it started in mid-1997). With unemployment now at least having peaked, and households' improved perceptions about the state of the labour market, wage growth is expected to also bottom out and start to recover into 2016.

For an outright recovery Q3 is probably still too early. Two things should, however, be noted. One, although nominal wage growth is running at the lowest rate since the series' inception, inflation adjusted wage growth at 0.8% yoy is fractionally above the historical average of 0.7%.

Two, wage growth including bonus payments is running at a slightly higher rate of 2.6% yoy, 0.3pp higher than the ex-bonus figure that for some reason grabs most of the headlines. So, the misery inflicted on Australia's wage earners is arguably less pronounced than this series suggests, and combined with employment growth of just above 2% yoy, real wages and salaries are growing at a solid rate.

Australia's wage growth bottoming out

Tuesday, November 17, 2015 9:24 PM UTC

Editor's Picks

- Market Data

Most Popular

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains