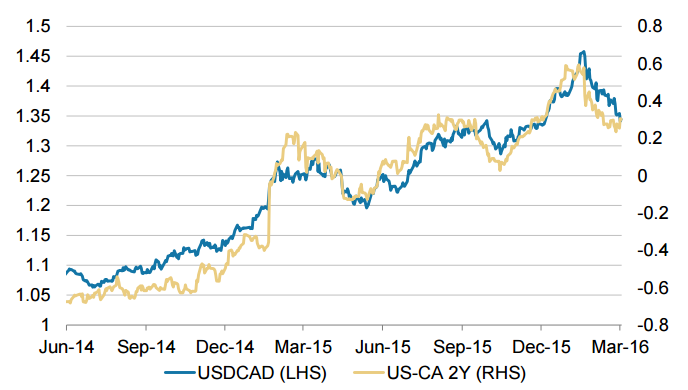

The Bank of Canada (BoC) holds its next policy meeting on 9 March and is largely expected to stay on hold. Tomorrow's meeting is likely to be a non-event with the odds of a rate cut being almost fully priced out and there is just a 1/3 chance of a cut priced by September (there was more than a full cut priced in just a few weeks ago). Market continues to price out the probability of rate cuts further down the line with only 11bp of cuts priced by year-end, down from around 25bp at the beginning of the year.

"This re-pricing has been a main factor in CAD's outperformance and, while we remain long-term bears on the currency, we believe CAD should remain supported in the near term", says Morgan Stanley in a research note.

At 0.8% SAAR, 4Q GDP was better than the BoC's forecast (0%) and certainly good enough in the short term to check the box for the BoC. Canada's trade balance for Jan came in at CAD -0.66bln better than forecasts at -0.9bln. Terms of trade (the price of exports relative to the price of imports) however declined sharply, reflecting the sharp drop in oil prices and the surging price of imports. Underlying details of the GDP print point to this dynamic with falling imports accounting for the largest positive contribution and consumption slowing to 1%.

BoC is unlikely to consider changing its policy rates until the fiscal stimulus is announced. The federal budget is to be revealed on March 22 and could mitigate the damage of the commodity price plunge. The BoC is expecting a fiscal boost from the March budget and would not change its policy prior to the budget's release. All of these factors suggest a constructive tone at the upcoming meeting and further pricing out of rate cuts by the market.

"Given this, and the current risk rally, we tactically buy CAD/JPY at market and expect the pair to do well in the run up to the budget release. However, we still look to sell CAD down the road as the fundamental picture hasn't changed." adds Morgan Stanley

USD/CAD is extending declines from 1.4690 (12-year highs) and is currently trading at 1.3322 levels at 1200 GMT, while CAD/JPY was at 84.90.

BoC to remain on the sidelines until announcement of the Federal budget, CAD to remain supported

Tuesday, March 8, 2016 12:18 PM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?