The Bank of England (BoE) back into focus this Thursday as it holds its first monetary policy meeting for 2017. Analysts widely expect the central bank to maintain its interest rate at a historic low of 0.25 percent amid stronger than expected lift in inflation which was more broad-based than widely anticipated and recovery in economic growth.

Concerns about an immediate recession have diminished as the weak pound is supporting exports and tourism so that growth in UK is not likely to be much weaker than in the euro zone. However, the high uncertainty about the future economic framework conditions is not only putting pressure on the long-term inflation outlook but also on the willingness of British and foreign companies to invest.

Britain's economy grew faster than expected in Q4 2016, according to a preliminary GDP release from the Office for National Statistics last week. According to the ONS' data, GDP grew by 0.6 percent in the quarter, in line the consensus forecast of economists who saw growth increasing by 0.5 percent. Further, on a year-to-year basis, growth was also above expectations. Also, the UK headline inflation data, released last week, has come in better than expected at 1.6 percent y/y(0.5 percent m/m).

The financial market is looking for the first BoE rate hike to occur in the second-half of 2018, which could at some stage start to be brought forward, should the tone of the minutes adopt a slightly hawkish hue against the backdrop of a rising inflation outlook. The release of minutes and the inflation report alongside the usual rate decision raises scope for some volatility.

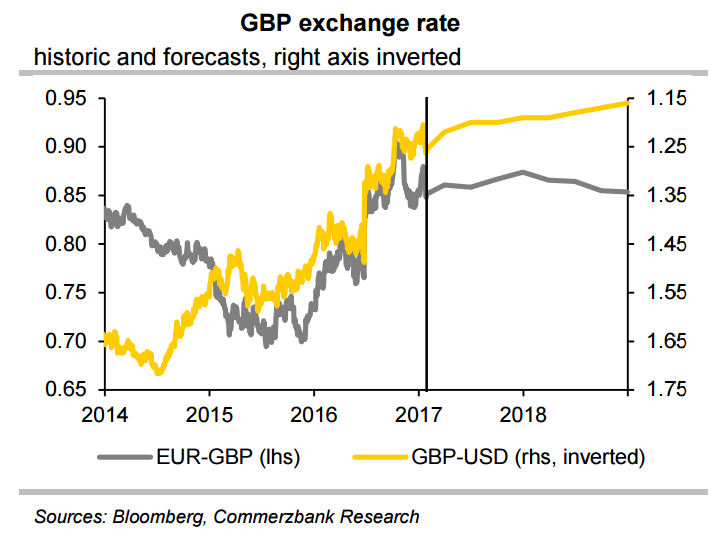

Release of growth and inflation forecasts will shape the Monetary Policy Committee’s outlook going forward. As the BoE will hesitate to take appropriate countermeasures in view of the economic uncertainty the GBP weakening effect of higher inflation will dominate and will be putting pressure on GBP exchange rates. GBP exchange rates to remain very sensitive to Brexit news, so volatility will remain elevated.

GBP/USD was trading at 1.2488, largely unchanged on the day. FxWirePro's Hourly Pound Strength Index remained bearish at -95.7853 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal