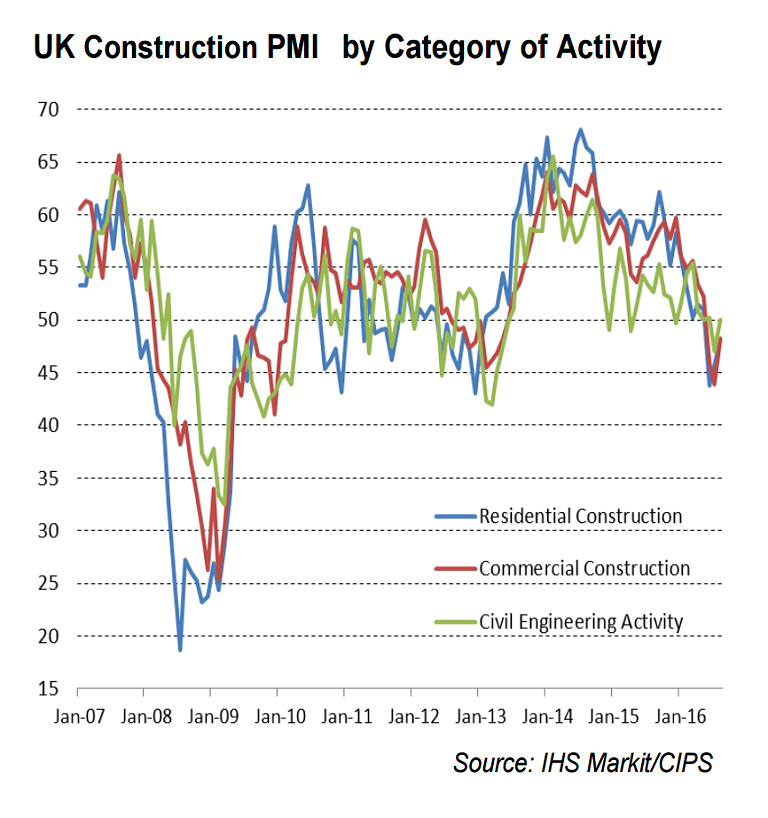

UK construction industry recovered more than expected in August, PMI data released earlier on Friday showed. The latest Markit/CIPS UK Construction Purchasing Managers' Index (PMI) rose to 49.2 in August from 45.9 in the previous month, beating forecasts at 46.1 in a Reuters poll. The overall construction activity, which accounts for about 6 percent of the economy - declined for a third straight month, remaining below the 50 mark dividing growth and contraction.

UK construction downturn that started just before June's vote to leave the European Union eased in August adding to signs the economy is stabilising. Looking ahead, construction firms pointed to a rebound in business confidence from July’s 39-month low.

Prices paid by construction firms for raw materials shot up at the fastest pace in just over five years, fuelled by the pound's plunge since Brexit. Also, manufacturing and services now reporting the highest rate of growth of input cost inflation for five years, as the weaker pound pushes up the cost of imported materials.

Tim Moore, senior economist at Markit and author of the Markit/CIPS Construction PMI, said: “The downturn in UK construction activity has eased considerably since July, primarily helped by a much slower decline in commercial building." However, the latest survey indicates only a partial move towards stabilisation, rather than a return to business as usual across the construction sector, Tim noted.

Today's data follows a surprisingly upbeat manufacturing PMI on Thursday, which showed that Britain's factories recorded activity of 53.3 in August, the highest level in 10-months and a huge acceleration from July's reading. The headline reading also represented the joint highest single monthly gain since the PMI survey began 25 years ago, jumping from 48.3, a 41-month low, in July. Consumer confidence also recovered somewhat last month after taking a huge plunge in July, according to market researchers GfK.

The Bank of England took action in early August to restore confidence among businesses and households and ward off a recession. It cut interest rates to a new record low of 0.25 percent and expanded its programme of bond purchases. Upbeat data could prompt the Bank of England to rethink the need to cut interest rates again.

"August’s construction and manufacturing PMIs provide encouraging news that any immediate hit to the economy from the uncertainty caused by the EU referendum may be more limited that previously feared,” said Chris Williamson, Chief Economist, Markit.

After hitting a 4-week high level of 1.3318 on Thursday following stellar manufacturing PMI data, GBP/USD seeing some profit taking ahead of the keenly watched US monthly jobs report. Trades largely unchanged on the day at around 1.3271 at around 12:00 GMT.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient