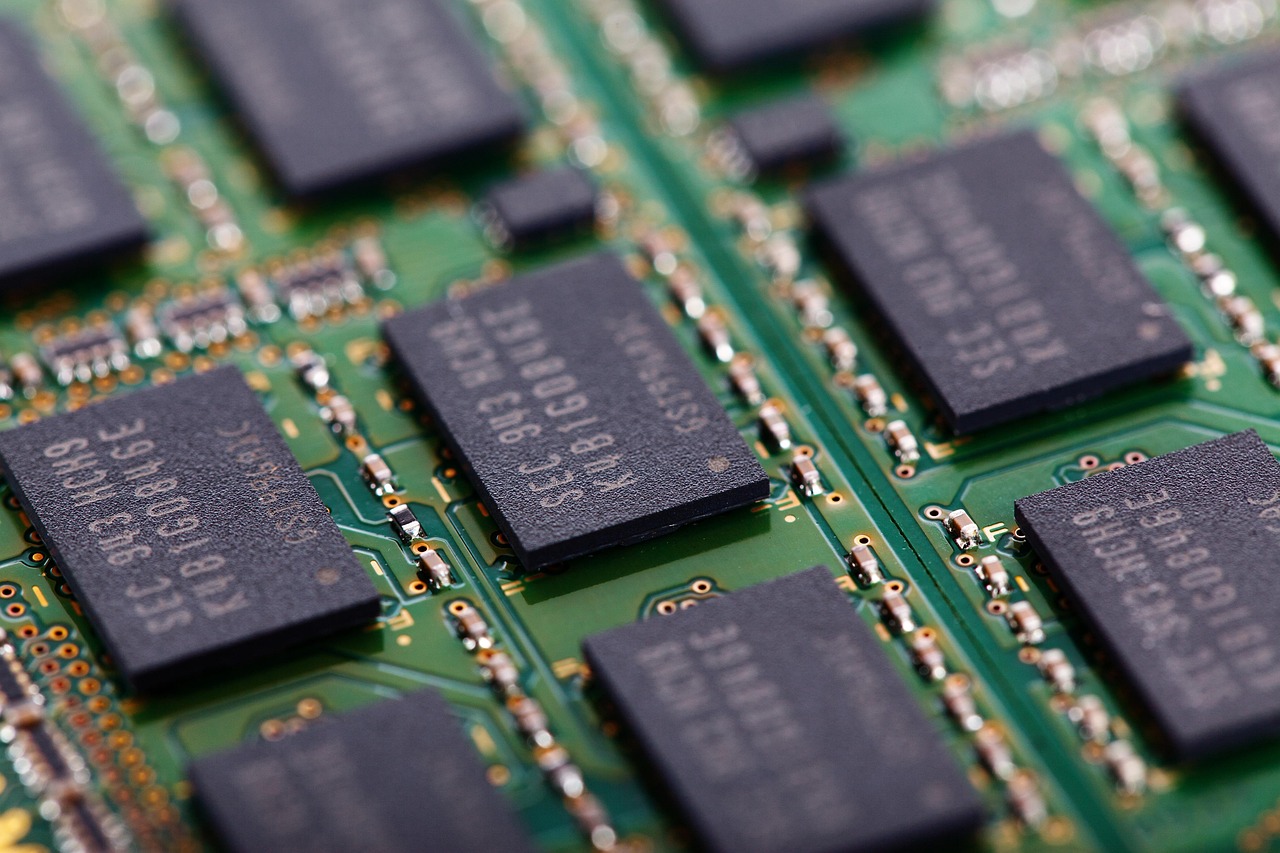

Cadence Design Systems will plead guilty and pay over $140 million to settle U.S. charges of illegally exporting chip design software and hardware to a Chinese military-linked university, the Justice Department announced Monday. The San Jose-based company was accused of selling electronic design automation (EDA) tools to front companies connected to China’s National University of Defense Technology (NUDT), which is believed to develop supercomputers for nuclear and military simulations.

NUDT, blacklisted by the U.S. Commerce Department since 2015, operates under aliases including Hunan Guofang Keji University and Central South CAD Center. Court filings revealed Cadence and its China subsidiary conducted at least 56 transactions with these entities between 2015 and 2020 and also transferred tools to Phytium Technology, another restricted company.

Under the plea deal, Cadence will face three years’ probation and pay combined criminal and civil penalties, including forfeiture. The company stated it was “pleased” to resolve the matter as it reported quarterly earnings, which sent its shares up 6.5%.

Cadence’s customers include major semiconductor players such as Nvidia and Qualcomm. The investigation began in 2021 with a Commerce Department subpoena, later followed by the Justice Department. The company’s former longtime CEO, Lip-Bu Tan, who now leads Intel, oversaw Cadence during the period in question but has not commented.

The case underscores Washington’s strict enforcement of export controls on sensitive U.S. technology, even as trade negotiations with China continue. EDA tools are essential for designing advanced chips, including those powering Tianhe-2, a supercomputer tied to nuclear research. China accounted for 12% of Cadence’s revenue in 2024, down from 17% in 2023 amid tightening U.S.-China tech tensions.

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Federal Judge Blocks Trump Administration Move to End TPS for Haitian Immigrants

Federal Judge Blocks Trump Administration Move to End TPS for Haitian Immigrants  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Federal Judge Rules Trump Administration Unlawfully Halted EV Charger Funding

Federal Judge Rules Trump Administration Unlawfully Halted EV Charger Funding  Court Allows Expert Testimony Linking Johnson & Johnson Talc Products to Ovarian Cancer

Court Allows Expert Testimony Linking Johnson & Johnson Talc Products to Ovarian Cancer  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  CK Hutchison Unit Launches Arbitration Against Panama Over Port Concessions Ruling

CK Hutchison Unit Launches Arbitration Against Panama Over Port Concessions Ruling  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  US Judge Rejects $2.36B Penalty Bid Against Google in Privacy Data Case

US Judge Rejects $2.36B Penalty Bid Against Google in Privacy Data Case