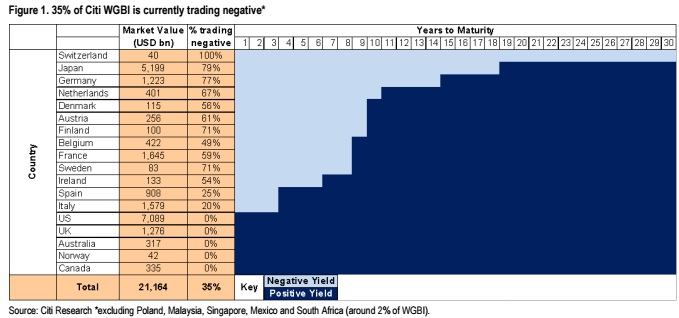

Negative yield universe is continuing its expansion. Globally now more than $11 trillion worth of government bonds are trading at a negative yield. In Switzerland the whole yield curve, up to 30 years trading in negative. In Japan, 20-year bond yield has dropped into negative yield territory today. Since the referendum in the UK, this negative universe has expanded by $1.2 trillion. Today German 10 year yield recorded a new low at -0.2 percent.

It seems investors are more worried about the return of their money than the return on it.

Chart courtesy - Citi Research, Financial Times

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty