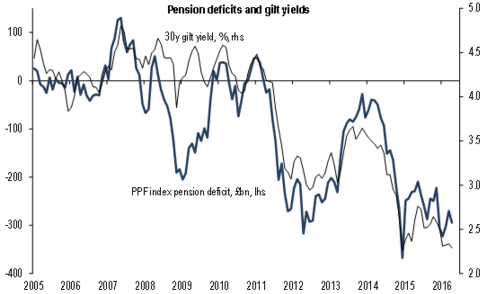

Central bankers have been assuring of no ill effects on savings from their low rates but this chart from Credit Suisse says otherwise.

Pension deficit seems to be directly proportional to the drop in Gilt yields. Since 2011, yield on the 30-year gilt has fallen from 4.5 percent to around 2.5 percent and pension deficit has widened from zero to more than £300 billion.

Central bankers would like to point out that the funds have capital gains but that would mean selling to cash in. We wonder, what might happen if all go for a cash in?

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed