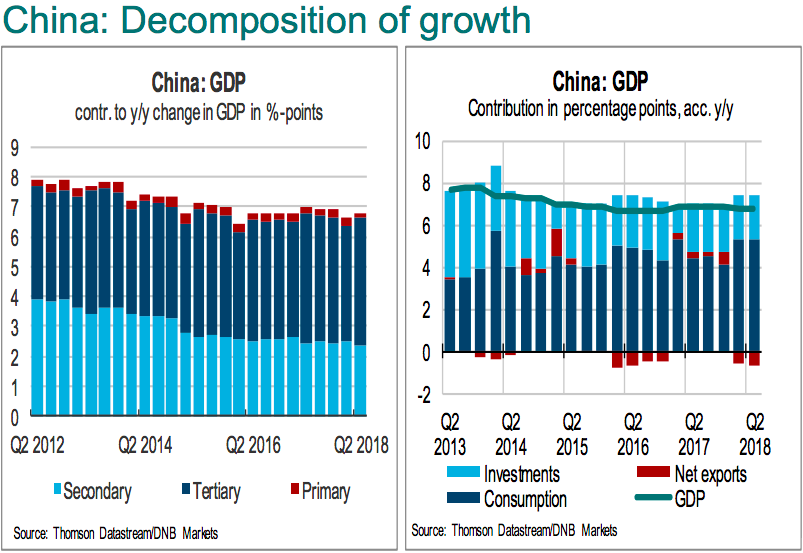

China’s gross domestic product (GDP) for the second quarter of this year cheered market participants while industrial production fell during the month of June. Underlying growth seems to be weakening after a strong development last year, as the drop in IP growth is showing signs of.

According to National Bureau of Statistics (NBS), Chinese GDP rose by 1.8 percent q/q in Q2, while the y/y growth rate fell by 0.1 percentage point to 6.7 percent y/y from Q1 to Q2.

Further, industrial production rose by 6.0 percentage y/y in June, while consensus had expected an increase of 6.5 percent y/y. Growth has slowed by 1 percentage point from April to June. The slowdown was broad based with a fall in the y/y growth rates for electricity, steel and glass, cement and iron ore.

In addition, retail sales rose by 9.0 percent y/y in June, up from 8.5 percent in May and higher than consensus’ expectations of an increase of 8.8 percent. Adjusted for price changes sales rose by 7.0 percent y/y, up by 0.2 percentage point from May.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality