China’s Ministry of Commerce announced on Friday it is reviewing export license applications for sensitive items, including rare earths and related magnets, as part of its ongoing trade discussions with the United States. The move follows Washington’s recent decision to lift certain export restrictions on semiconductor design software and other technologies bound for China, signaling a thaw in bilateral trade tensions.

Rare earths, vital for electronics and defense technologies, have long been a strategic asset for Beijing, which dominates global production. During heightened U.S.-China trade disputes earlier this year, China had sharply curtailed rare earth exports, using them as leverage in negotiations. However, a framework trade agreement reached in May led to reduced tariffs on both sides and paved the way for greater cooperation.

In late June, the Chinese commerce ministry issued new export licenses to three of the country’s top rare earth producers, reportedly in line with the May deal. The ministry stated it is now actively working to implement further outcomes from that agreement and expressed openness to additional collaboration with Washington.

Meanwhile, Reuters reported that the U.S. also lifted bans on American-made jet engine components destined for China, adding momentum to the improving trade relationship.

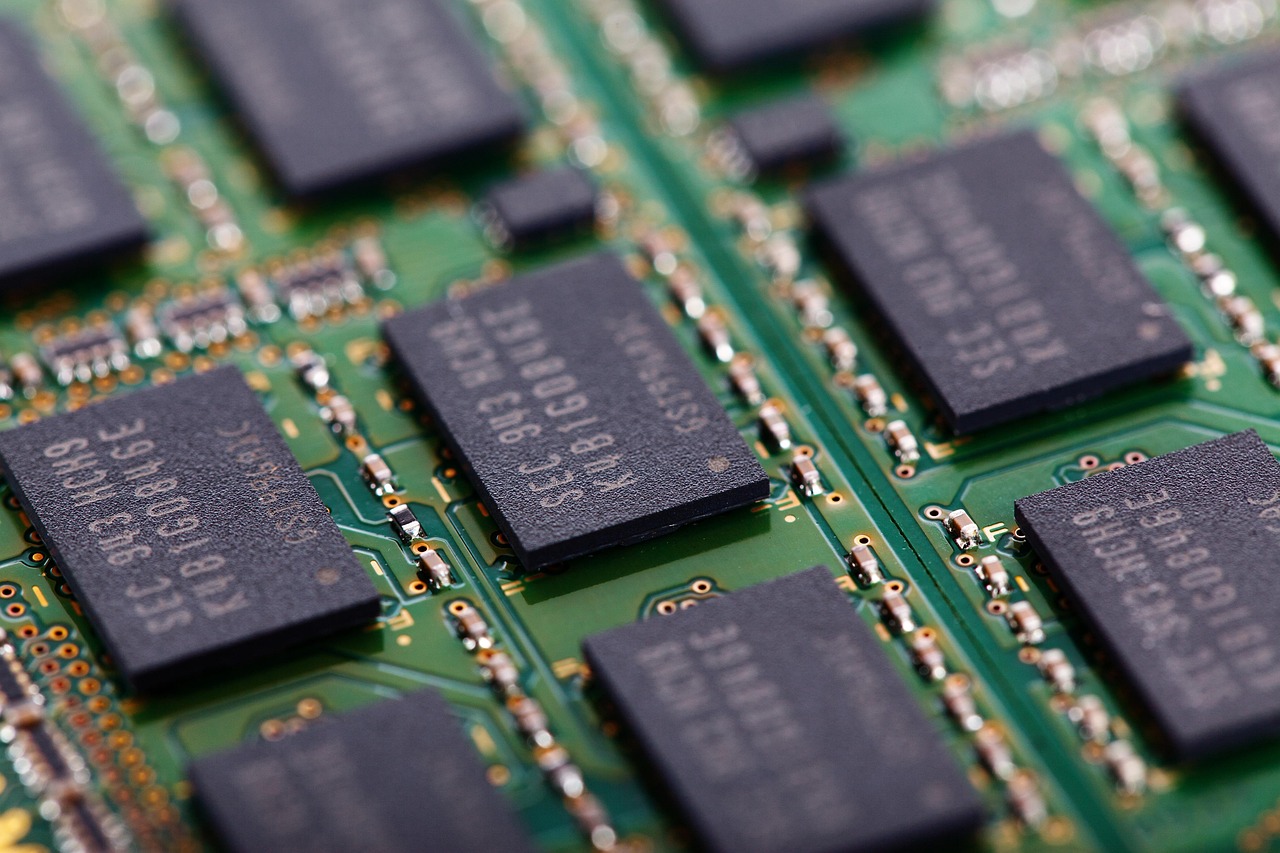

Export controls on chip technology, introduced during the Trump administration, had been a significant point of contention for Beijing. With recent developments, both countries appear to be easing tensions, aiming to stabilize supply chains and support economic growth through mutual trade benefits.

These latest shifts reflect a broader strategy from both nations to balance national security concerns with commercial cooperation, particularly in critical sectors such as rare earths and advanced manufacturing technologies.

Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Federal Judge Blocks Trump Administration Move to End TPS for Haitian Immigrants

Federal Judge Blocks Trump Administration Move to End TPS for Haitian Immigrants  China Approves First Import Batch of Nvidia H200 AI Chips Amid Strategic Shift

China Approves First Import Batch of Nvidia H200 AI Chips Amid Strategic Shift  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  U.S. Justice Department Removes DHS Lawyer After Blunt Remarks in Minnesota Immigration Court

U.S. Justice Department Removes DHS Lawyer After Blunt Remarks in Minnesota Immigration Court  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall

Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions