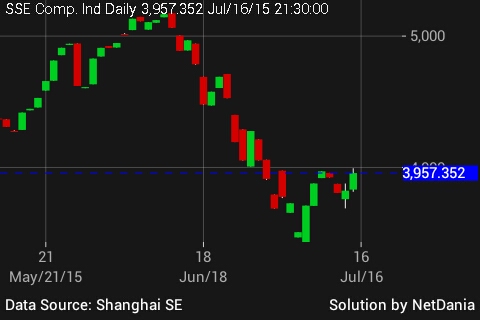

Chinese authorities brought out further measures to stem stock market crash, which has already wiped out trillion of dollar in valuation.

- China's biggest state-owned banks have lent a combined Yuan 1.3 trillion ($209 billion) to the country's margin finance agency, Securities Finance Corporation (SFC) in recent weeks to staunch a free-fall in the stock market.

- 17 banks provided this total Yuan 1.3 trillion. China Merchants Bank, provided the largest single loan, at Yuan 186 billion.

In response Chinese benchmark stock index, Shanghai composite is up 3.5%, while Shenzhen stock index is having best one day rally since 2012. Shenzhen composite index rose 5%, best single day rally since January 2012.

- Country's 21 brokers have set a fund of Yuan 120 billion, however market doubted the sheer size since is not enough to last in a day of turmoil in world's most volatile stock market.

- However this Yuan 1.3 trillion is sufficiently large enough to prevent major stock crash, moreover to reduce the volatility. This move brings total war chest at Securities Finance Corporation at Yuan 2 trillion. SFC recently issued bonds in the interbank market, which fetched Yuan 800 billion.

China's stocks have recovered more than 15% from its recent low, however doubts remain whether it can grow on its own without government backing.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary