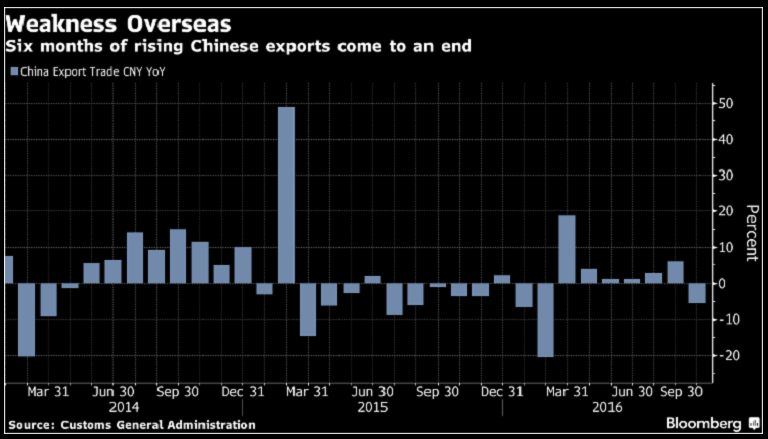

Exports in China fell to a seven-month low during the period of September, adding to rising yuan pressure, which is at near six-year low.

China’s exports fell 10 percent from a year earlier in September, data released by the customs administration department showed Thursday. Further, imports declined 1.9 percent from a year earlier, reversing a 1.5 percent increase in August. The decrease contrasts with a median forecast for a 1.0 percent gain.

In yuan terms, shipments declined 5.6 percent, imports rose 2.2 percent; trade surplus fell to USD42 billion, from USD52.05 billion the previous month, falling short of forecast for a USD52.30 billion surplus, data showed.

In addition, exports to the European Union fell 9.8 percent, U.K. shipments slid 10.8 percent,while U.S. down 8.1 percent . Crude oil imports rose to a record as a new strategic reserve site became operational and steel exports shrank for a third month to the lowest since February, Bloomberg reported.

Moreover, yuan depreciation’s impact on trade is limited, customs spokesman says at a briefing; the yuan has dropped 3.4 percent against the dollar this year, the biggest decline in Asia and weakened 6.2 percent against a 13-currency trade-weighted index.

Meanwhile, the People’s Bank of China on Thursday weakened the daily reference rate for the seventh day in a row, 6.7296, 0.06% weaker than 6.7258 yesterday, the longest weakening run since January.

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals