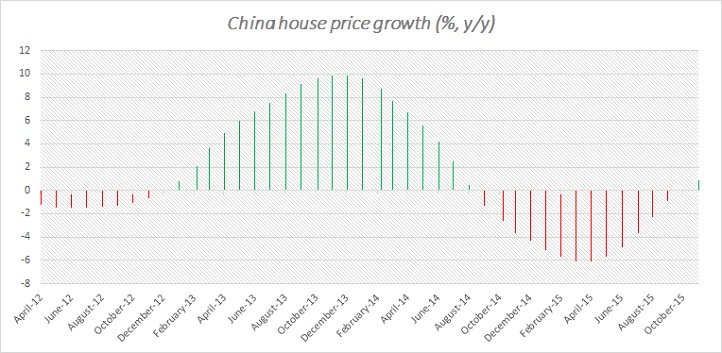

Life may be returning to China's ailed housing sector as prices moved up steadily for seventh consecutive month. Prices in 70 cities surveyed up by 0.3% in November, after rising 0.2% in October. On yearly basis prices have recovered from deflation to up by 0.9% in November.

Large chunk of the rises are due to price hump in Tier one cities. In capital Beijing up 7.7% from a year ago, while in financial hub Shanghai prices are up by 13.1%. While prices have jumped up solid in Tier one cities like Beijing, Shanghai, Guangzhou, Shenzhen, in some Tier three and four cities prices are in decline. Inventory still high in greater China.

Nevertheless this recovery and stabilization is broadly encouraging, since the construction sector contributes about 7% to GDP.

Some of the policy measures taken up, might be producing intended effect. People's Bank of China (PBoC) has cut rates six times in last 12 months and reduced down payment required for second house purchase thrice already.

Further measures are likely to come in 2016.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility