Change in China’s Forex reserves has to a large extent been a reliable and timely indicator to show China’s capital flows. However, Forex reserves cannot be the sole indicator to assess capital flows as valuation effects could bring significant impact to the FX reserves. China's cross-border payments could divulge more details of the pattern of outflows.

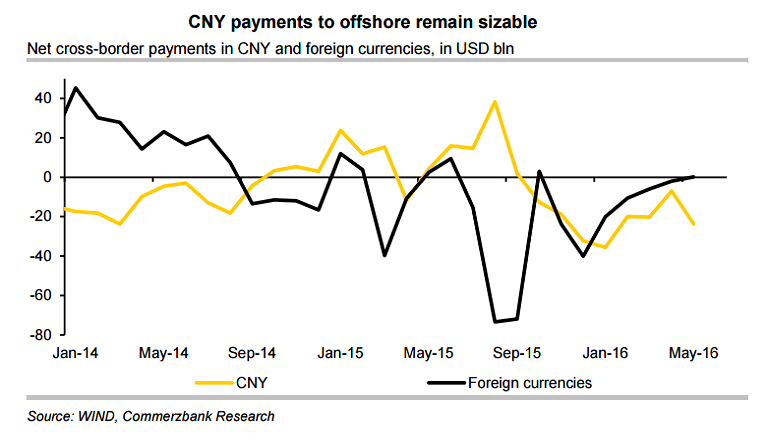

Chinese authorities have implemented strict controls and closely monitor the payments of foreign currencies. CNY cross-border payments, on the other hand, are much easier as the authorities see the outflows of local currencies are not as harmful as outflows of foreign currencies. China's net cross-border payments have been negative for ten consecutive months since last August “one-off devaluation” in CNY.

Even as net payments in foreign currencies have narrowed significantly in recent months, the net payments to overseas in CNY remains sizable. As the USD purchase transactions have been strictly regulated in onshore market, some corporates and residents transfer their CNY to overseas for FX conversion. USD-CNH rates have moved higher and CNY payments to offshore market are seen as the driving force. CNH deposits in Hong Kong continued to drop in the past three-quarters. Cost of CNH funds also remains low despite smaller CNH funding pool, indicating falling demand for CNH.

“Capital outflows have been continuing at pace and they are a lot larger than what the authorities would have us believe through the official data,” said Sue Trinh, Hong Kong-based head of Asia FX strategy at the Royal Bank of Canada.

Data released by the People's Bank of China (PBoC) showed on Thursday that China's foreign exchange reserves in June unexpectedly rose $20 billion to $3.21 trillion, rebounding from a 5-year low in May. Data indicates that the PBOC didn’t heavily intervene in the currency market last month as it let the yuan depreciate in accordance with market supply and demand.

As the PBOC continue to let the renminbi (yuan) slide against the dollar and demand for CNH continues to dwindle, serious concerns over the trajectory of the currency could re-emerge. The net payments to overseas normally picked up when CNY weakened in a faster pace and this could lead to another surge in capital outflows.

"All in all, China still faces significant capital outflow pressures, implying that further depreciation in CNY is inevitable. Notably, a weakening outlook on CNY will have negative consequence on the offshore market developments as well," said Commerzbank in a report.

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings