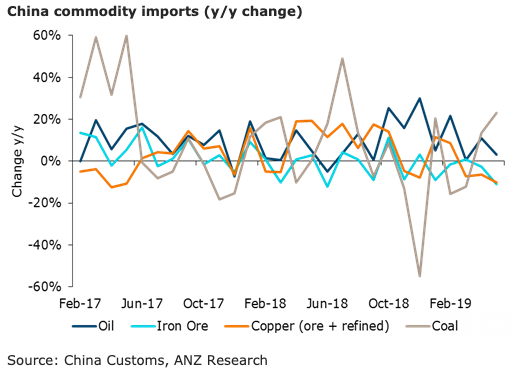

China’s commodities imports remained mixed during the month of May. While it is still too early to conclude if the renewed trade tensions have impacted imports in May, worsening trade relations between China and the US remain a key headwind for commodity demand.

Further, the country’s stimulatory measures are expected to potentially mitigate some of the demand concerns, according to the latest report from ANZ Research.

As expected, crude oil imports slowed following strong imports in April ahead of the removal of sanction waivers on Iranian oil. Tighter margins amid increased inventories of oil products have encouraged refiners to shut their plants for maintenance, and this kept crude oil demand weaker.

"We see tighter supplies and lower margins for refiners to keep imports lacklustre next month as well," the report added.

China’s refined copper imports stayed softer in May, while concentrate imports continued to rise by 16 percent y/y and 11 percent m/m. Lower prices and recovery in Chinese physical premium should keep imports strong next month.

Iron ore imports recovered following a steep drop in April, but are still down on a y/y basis as a result of the mine closures in Brazil and weather-related disruptions in Australia. However, diminishing stockpiles in Brazil could further weigh on exports. This will likely keep Chinese imports depressed in the short term, ANZ Research further noted.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns