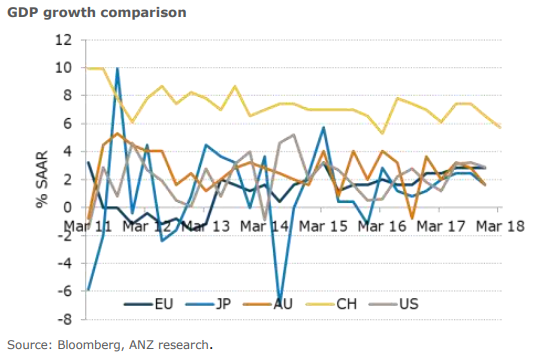

China’s gross domestic product (GDP) momentum for the first quarter of this year remained solid even with a slower sequential growth. Q1 GDP slowed to 1.4 percent q/q (seasonally adjusted) from 1.6 percent in Q4 2017. In saar terms, China’s GDP increased 5.7 percent in Q1, indicating potentially lower annual GDP growth for 2018 than in 2017.

Nonetheless, on a y/y basis, China’s GDP increased 6.8 percent y/y, on par with Q4 2017. This will provide a cushion to a likely moderation in GDP growth in H2 amid the country’s intensive reform efforts. Economic transition is still underway with the tertiary sector contributing 4.2 percentage point to overall Q1 GDP growth. The tertiary sector’s contribution as a percentage of GDP rose to 56.6 percent in Q1 2018, up from 56.3 percent in Q1 2017.

The sector grew 7.5 percent y/y in Q1, compared with 3.2 percent growth in the primary sector and 6.3 percent in the secondary sector. Fixed asset investment (FAI) growth in the tertiary sector also accelerated to 10 percent y/y in Q1 from 9.5 percent in 2017, while the manufacturing sector continued to slow to 3.8 percent y/y in Q1 from 4.8 percent in 2017.

"We do not think the slowdown in nominal GDP growth and its implied GDP deflator indicates any deterioration in China’s debt mechanism. The moderation in nominal GDP growth to 10.2 percent y/y, with its implied GDP deflator shrinking to 3.4 percent y/y in Q1, may raise concerns on whether it will pose a challenge to China’s leverage mechanism," ANZ Research commented in its latest report.

But China’s latest efforts in cracking down on the shadow banking sector and directing credit back to the real economy will likely help alleviate its debt pressure and mitigate risks. More importantly, relying less on leverage to boost GDP growth via structural reforms instead of depending on inflation to gradually dilute the debt-to-GDP ratio is the key to resolve China’s debt issue, from a longer-term perspective.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility